FUND PICK: L&T India Value Fund

Consistently generating higher returns

Crisil Research Launched in January 2010, L&T India Value Fund is classified under the diversified category of the CRISIL Mutual Fund Ranking. It has been ranked in the top 30 percentile (CRISIL Fund Rank 1 or 2) over the past five consecutive quarters ended June 2016.

The fund aims at providing long-term capital appreciation from diversified portfolio of predominantly equity and equity related securities in the Indian markets with higher focus on undervalued securities.

It is jointly managed by Venugopal Manghat and Abhijeet Dakshikar. The fund had quarter average assets under management of Rs 1,593 crore at the end of September 2016 quarter.

Superior performance L&T India Value Fund has been a consistent outperformer. It outperformed the category (funds ranked under the diversified category in June 2016 CRISIL Mutual Fund Ranking) and the benchmark - S&P BSE 200, across all time frames under analysis by a strong margin.

The fund stood the test of time as it outperformed the category and the benchmark across bearish and bullish market phases. It performed very well during the post European crisis phase (July 2013, February 2015) with 54.0 per cent CAGR (compounded annual growth rate) returns. During the latest ongoing phase of Chinese slowdown (March 2015-October 2016), it delivered 12.8 per cent annualised returns compared with 5.9 per cent and 0.9 per cent by the peer group and the benchmark, respectively.

Since inception the fund has registered about three-fold growth.

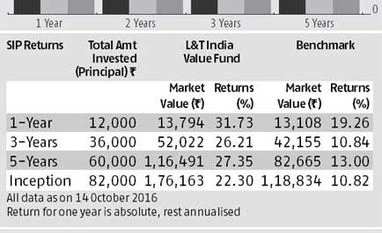

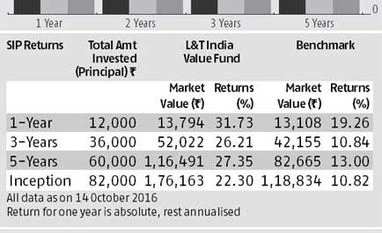

An investment of Rs 1,000 in the fund on January 8, 2010 would have grown to Rs 2,927 (compounded annualised returns of 17.19 per cent) on October 14, 2016. A similar investment in the category and the benchmark would have grown to around Rs 2,286 (12.96 per cent) and Rs 1,687 (8.03 per cent), respectively. Investments into the fund via the systematic investment plan (SIP) route has also delivered strong returns (see table) compared to its benchmark index, S&P BSE 200.

Portfolio analysis As of September 2016, the fund had exposure to 80 stocks across 26 sectors.

Over the past three years, the fund has had exposure to 34 sectors and the top five sectors, on average, accounted for 52.71 per cent of the fund's portfolio. Over this period, the banking sector had the highest exposure of 14.37 per cent followed by software (9.20 per cent), cement (6.52 per cent), petroleum products (6.12 per cent) and finance (5.57 per cent).

Over the past three years, the fund has taken exposure to 191 stocks, of which only six stocks have been held consistently indicating proactive fund management. The average exposure of these stocks over three years accounts for 14.13 per cent of the total portfolio. Top holdings among the consistently held stocks include ICICI Bank with average exposure of 3.95 per cent followed by Infosys (3.93 per cent) and State Bank of India (2.17 per cent).

)

)