Indian cement companies top global valuation chart

Shree Cement is now the world's most expensive cement maker followed by Ultratech Cement

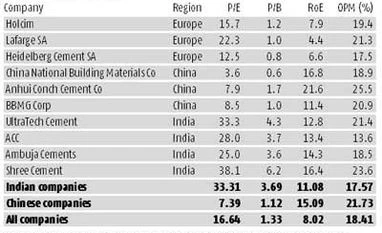

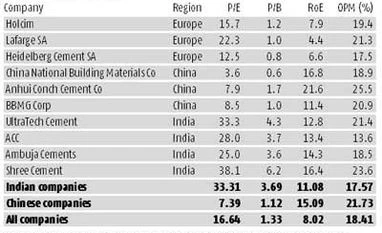

Krishna Kant Mumbai Indian cement makers are now the costliest in the world, with a price-to-earnings multiple nearly double that of their global peers and four times that of top Chinese cement makers. Currently, India’s cement makers are trading at about 33 times their net profits for the last four quarters, against the global average of 16.5 and 7.4 for Chinese companies. These cement makers also top the charts for the ratio of price to book value. At current share prices, these companies are valued at 3.7 times their book value, or net worth. The corresponding ratios for their global and Chinese peers are 1.2 and one, respectively, according to Bloomberg data.

This analysis is based on data for the top 30 listed cement companies---10 each from India, China and the rest of the world. The companies in this sample reported combined revenue of $169 billion and a net profit of $11 billion for the year ended June this year. In terms of revenue, these companies account for about two-thirds the global cement market, estimated at $234.6 billion in 2013, according to data from market research firm Transparency Market Research.

Many see further upsides in cement stocks. “Cement makers are likely to report strong earnings growth from the second half of this financial year and this will more-than-make-up for the current high valuations,” says Sanjay Singh, cement analyst at Centrum Broking. Among companies, the Shree Cement stock is the world’s most expensive cement counter, valued at 38 times its trailing 12-month net profit and more than six times its latest net worth. Shree Cement is followed by Ultratech Cement, trading at 33 times its trading earnings and 4.3 times its latest net worth.

By comparison, Lafarge SA, the world’s largest cement maker excluding China, is currently trading at 22.3 times its trailing earnings and on a par with its net worth. It peer Holcim is trading at 15.7 times its trailing earnings and 1.2 times its latest net worth.

The valuations are lower in China, the world’s largest cement market. In that country, the top cement maker by capacity, Anhui Conch, is trading at eight times its trailing annual net profit and 1.7 times its net worth. China National Building Material Company, the world’s second-largest building material supplier by revenue (after Holcim) is valued at just 3.6 times its trailing earnings; it is trading at a discount to its net worth.

Chinese companies are trading at a discount despite reporting some the best financial ratios in the sector. These companies reported an operating margin of 21.7 per cent, against 17.6 per cent in India and 17.1 per cent elsewhere. Also, they top the charts for return on equity, at 15 per cent, against 11.1 per cent for Indian companies and 5.3 per cent for others.

Brushing aside any fear of a bubble in cement stocks, analysts point to the growth opportunity. “Right now, valuations aren’t stretched. Earnings are at their low point in the cycle and if GDP (gross domestic product) growth and infrastructure investment takes off, there will be a dramatic surge in their earnings. This has led to a re-rating,” says Jinesh Gandhi, cement analyst at Motilal Oswal Securities.

Others say cement stocks have become a proxy for the infrastructure and real estate sectors, just as Bhel was a proxy for the power sector in the previous bull-run. “As there are few quality stocks in real estate and infrastructure, investors are piling on cement stocks to take advantage of the new government’s focus on these two sectors. This gives top cement makers some scarcity premium, leading to higher price multiples,” says Devang Mehta, senior vice-president and head (equity sales) at Anand Rathi Financial Services.

This is clear in the increasing heft of Indian cement makers in the global league table. Now, Indian cement makers account for 17.2 per cent of the entire sample with combined market capitalisation of $184 billion, nearly three times their revenue share and more than twice their profit share. By contrast, Chinese cement makers account for a fifth of the market cap, despite 28.2 per cent revenue share and 45 per cent share in net profits. At this rate, Indian cement makers might soon surpass their Chinese peers in terms of market capitalisation.

)

)