AIBOC said that IBA had recommended the proposed change to the government, which is now awaiting approval from the Reserve Bank of India (RBI) and the Centre.

A senior official from the IBA said: “We are in continuous talks with both the government and employee unions, but as of now, no final decision has been reached.”

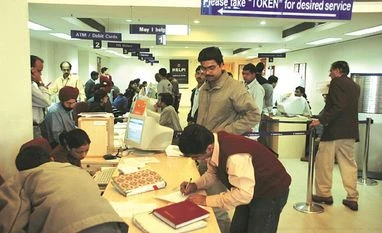

The demand for a five-day work week comes amid a shift in the banking industry’s staffing pattern. Official data shows public sector banks (PSBs) have seen a drastic reduction in workforce over the past decade.

The number of clerks has dropped from 398,801 in 2013 to 246, 965 in 2024, a decrease of 151,836 employees. Sub-staff numbers have dropped from 153,628 in 2013 to 94,348 in 2024. Overall, PSBs have seen a reduction of 139,811 employees in this period.

)