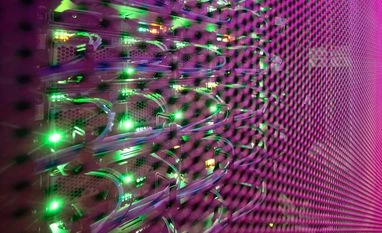

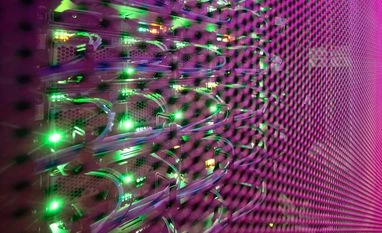

Data centre capacity to more than double to 2,100 MW by FY27: ICRA

Icra Vice President Anupama Reddy said the surge in data generation and the push for data localization are driving a transformative shift in India's data centre landscape

)

Explore Business Standard

Associate Sponsors

Co-sponsor

Icra Vice President Anupama Reddy said the surge in data generation and the push for data localization are driving a transformative shift in India's data centre landscape

)

India's data centre capacity is expected to reach 2,000-2,100 megawatts (MW) by FY2027, with anticipated investments of Rs 50,000-55,000 crore fuelled by digital boom and data localisation efforts, according to credit rating agency Icra.

The current capacity stands at 950 MW, with major players like NTT Global Data Centers, CtrlS Data Centres, STT Global Data Centers, Sify Technologies and Nxtra Data controlling 85 per cent of the market (as of March 2024), Icra said in a statement.

Icra Vice President Anupama Reddy said the surge in data generation and the push for data localization are driving a transformative shift in India's data centre landscape.

"The low data tariff plans, access to affordable smartphones, adoption of new technologies and growing user base of social media, e-commerce, gaming and OTT platforms are some of the key triggers for data explosion," she said.

Moreover, artificial intelligence (AI) led demand, which is expected to increase multi-fold in the next 3-5 years, presents significant opportunities.

Around 95 per cent of the existing capacity is in six cities with Mumbai and Chennai leading the race, Icra said.

Mumbai remains the focal point for data centre development, contributing over 50 per cent of existing capacity due to its strategic advantages in connectivity and power reliability, and is expected to remain the key location for the upcoming data centre capacity in India.

As demand for co-location services grows, particularly from hyperscalers and sectors like banking and IT, revenues for data centres are projected to rise sharply by 23-25 per cent YoY in FY2025, Icra said.

Co-location refers to the practice of housing multiple servers and computing hardware in a shared data centre facility, reducing the costs of building and maintaining data centres.

Furthermore, as environmental concerns gain traction, Indian data centre operators are expected to increase their investment in green power from currently below 5 per cent to an anticipated 20-25 per cent by 2028, it said.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Oct 22 2024 | 3:35 PM IST