As Trump trade fades, investors reverse course

Developing doubt about administration's ability to deliver quickly on its agenda upends a strategy

)

premium

The Trump trade is over. Get ready for “Trump Lite.” Developing doubt about the U.S. administration’s ability to deliver on its pro-growth policy agenda—at least any time soon—has upended a strategy that had been a winner since November’s U.S. election: sell bonds, buy the U.S. dollar and pick up cheap stocks that might benefit from improved U.S. growth.

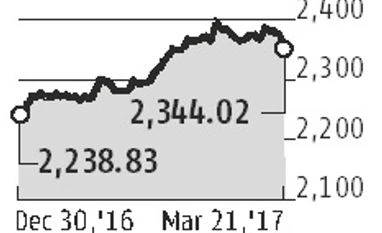

That trade went into reverse in Tuesday’s U.S. trading: The S&P 500 fell 1.2%, its first decline of more than 1% this year and biggest drop since October, while the ICE U.S. dollar index, which tracks the dollar against a basket of six currencies, slipped below 100 for the first time since Feb. 6.

But even before the reversal there had been weeks of stall. In fact, a more successful strategy this year than the Trump trade has been to discount a U.S. recovery and bet instead on Europe and Asia, particularly China. The MSCI Emerging Markets Index is up 8.6% in 2017—driven by double-digit gains in Turkey, China, Hong Kong and India—trumping the S&P 500’s 4.7%. Even European stocks have outperformed the U.S. over the past month, despite concerns around France’s coming election.

That trade went into reverse in Tuesday’s U.S. trading: The S&P 500 fell 1.2%, its first decline of more than 1% this year and biggest drop since October, while the ICE U.S. dollar index, which tracks the dollar against a basket of six currencies, slipped below 100 for the first time since Feb. 6.

But even before the reversal there had been weeks of stall. In fact, a more successful strategy this year than the Trump trade has been to discount a U.S. recovery and bet instead on Europe and Asia, particularly China. The MSCI Emerging Markets Index is up 8.6% in 2017—driven by double-digit gains in Turkey, China, Hong Kong and India—trumping the S&P 500’s 4.7%. Even European stocks have outperformed the U.S. over the past month, despite concerns around France’s coming election.