ICICI Bank: Just an optical improvement

Helped by closure of JP Associates deal, NPAs look lower than Q4 levels

)

premium

ICICI Bank's standalone June quarter (Q1) results, announced after market hours, weren't any encouraging, except that the bank was rescued to a thankful extent by the closure of JP Associates' cement plant sale deal with UltraTech on June 29.

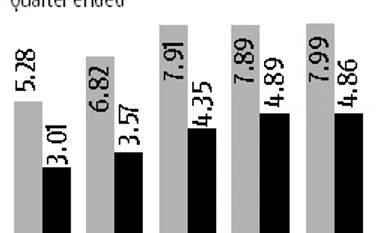

An eight per cent year-on-year (y-o-y) growth in net interest income at Rs 5,590 crore wasn't enough to cushion the bad loan provisioning. Net profit fell eight per cent y-o-y to Rs 2,049 crore. The year-ago period included exchange rate gains of Rs 206 crore, a practice discontinued after a Reserve Bank directive in April 2017. The first quarter of last year included quarterly dividend of Rs 204 crore from ICICI Prudential Life Insurance Company. Adjusted for these, profits would have grown marginally.

Domestic net interest margin (a profitability indicator) of 3.62 per cent was more than 3.45 per cent a year ago.