Budget 2017: What may be in store for GMR Infrastructure stock

A look at how the stock has moved in the past year and what it may get from Budget 2017

)

With interest in roads, airports and power, Street expectations are typically higher for GMR, leading to pre- and post-Budget volatility in the stock. The government had increased plan outlay by 49 per cent in 2016-17, as it announced plans for 10,000 km of national highway orders and 50,000 km of state highway upgradation. Incentives to the power sector by way of improved coal availability, gas power subsidy and distribution incentives did come but coal cess was a dampener.

Current Budget: Higher infra spends should help GMR, which is under pressure. Measures to improve power demand, given that supply exceeds demand, and steps to improve in financial health of state distribution companies will be crucial. Higher offtake of power will help GMR.

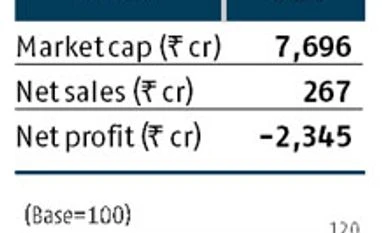

Note: Net sales and net profit are for trailing 12 months ended September 2016; Price, market cap and PE ratio are as on Jan 25, 2017; sales, profit and market cap figures are rounded off. Source Capitaline/Exchange

ALSO READ:

(Click on the name to read about the stock)

DLF, Adani Ports, Ashok Leyland, ITC, M&M Finance, Siemens, BHEL, Cipla, IDBI Bank

ALSO READ:

(Click on the name to read about the stock)

DLF, Adani Ports, Ashok Leyland, ITC, M&M Finance, Siemens, BHEL, Cipla, IDBI Bank

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 27 2017 | 1:29 AM IST