Budget 2017: What may be in store for ITC stock

A look at how the stock has moved in the past year and what it may get from Budget 2017

)

Heightened noise around the possibility of higher excise duties on cigarettes has lent more volatility to the scrip over the past few years, especially around the Budget. According to the analysts’ estimates, cigarette companies have witnessed cumulative hike of 125 per cent in duties over the past five years. Though ITC has passed on these increases via price hikes, these have led to a drop in cigarette sales volumes.

Current Budget: Analysts expect a modest 10 per cent rise in excise duty on cigarettes. Clarity on taxation of cigarettes under the Goods and Services Tax (GST) regime would be key. Updates on the possible licensing of non-cigarette tobacco products would create a level playing field. GST and licensing could also expedite a shift in favour of organised players, currently a fraction of the industry.

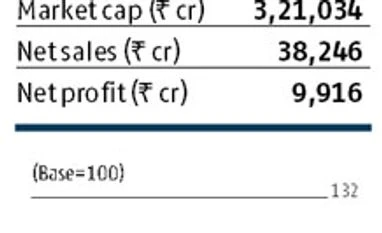

Note: Net sales and net profit are for trailing 12 months ended September 2016; Price, market cap and PE ratio are as on Jan 25, 2017; sales, profit and market cap figures are rounded off. Source Capitaline/Exchange

ALSO READ:

(Click on the name to read about the stock)

DLF, Adani Ports, Ashok Leyland, M&M Finance, Siemens, BHEL, Cipla, GMR Infra, IDBI Bank

Note: Net sales and net profit are for trailing 12 months ended September 2016; Price, market cap and PE ratio are as on Jan 25, 2017; sales, profit and market cap figures are rounded off. Source Capitaline/Exchange

ALSO READ:

(Click on the name to read about the stock)

DLF, Adani Ports, Ashok Leyland, M&M Finance, Siemens, BHEL, Cipla, GMR Infra, IDBI Bank

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 27 2017 | 12:41 AM IST