Budget 2017: What may be in store for Adani Ports stock

A look at how the stock has moved in the past year and what it may get from Budget 2017

)

Every year, the extension of tax sops for Special Economic Zones (SEZs) and its infrastructure business has kept Adani Ports’ stock busy prior to the Budget day. While SEZ doesn’t contribute much to the company’s revenue, withdrawal of exemption is viewed as a dampener to its earnings.

Current Budget: There is hope that the tax breaks for SEZs could be expanded, given the government’s intention to push infrastructure spending and promote its ‘Make in India’ campaign. This is keeping the stock elevated. The Street is also expecting more sops for infrastructure companies, in general, and this is viewed as critical to revive the private sector capex cycle.

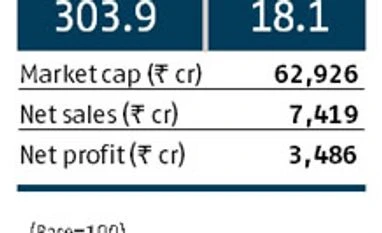

Note: Net sales and net profit are for trailing 12 months ended September 2016; Price, market cap and PE ratio are as on Jan 25, 2017; sales, profit and market cap figures are rounded off. Source Capitaline/Exchange

ALSO READ:

(Click on the name to read about the stock)

DLF, Ashok Leyland, ITC, M&M Finance, Siemens, BHEL, Cipla, GMR Infra, IDBI Bank

Note: Net sales and net profit are for trailing 12 months ended September 2016; Price, market cap and PE ratio are as on Jan 25, 2017; sales, profit and market cap figures are rounded off. Source Capitaline/Exchange

ALSO READ:

(Click on the name to read about the stock)

DLF, Ashok Leyland, ITC, M&M Finance, Siemens, BHEL, Cipla, GMR Infra, IDBI Bank

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 27 2017 | 12:26 AM IST