Fintech Platform Endl Secures 1.5 Million Dollar Investment to Scale Global Payment Infrastructure

Fintech Platform Endl Secures 1.5 Million Dollar Investment to Scale Global Payment Infrastructure

VMPL

New Delhi [India], February 13: Fintech platform Endl has raised 1.5 million dollars in pre-seed funding with participation from Iterative Singapore, 500 Global, and the XRPL Accelerator by Tenity. The investment marks a significant step in the company's mission to modernise cross border payments for businesses operating in emerging markets.

The funding will support Endl's expansion across South East Asia, the Middle East, and India, while strengthening its product capabilities and regulatory infrastructure. As global commerce becomes increasingly digital, the company is positioning itself at the intersection of traditional finance and blockchain powered payments.

Reimagining how global payments work

Endl offers businesses a unified platform to manage multi currency accounts, hold and convert fiat and stablecoins, and execute international payouts with speed and transparency. In addition to its banking and settlement tools, the company also provides Endl Corporate Cards, enabling businesses to directly spend their global balances across online and offline merchants worldwide.

These cards are linked to users' multi currency and stablecoin wallets, allowing seamless conversion at the point of transaction and giving companies greater control over international expenses, subscriptions, and operational spending. By integrating regulated banking rails, stablecoin infrastructure, and corporate spending tools, Endl is creating a complete financial operating system for modern businesses.

Unlike conventional fintech solutions that treat digital assets as add ons, Endl has built its architecture with stablecoins at the core. This allows the platform to optimise liquidity, reduce intermediaries, and deliver near real time settlements while maintaining full compliance.

Reflecting on this approach, Co Founder Ashita Batra said,

"Endl empowers both Web3 and Web2 organizations with USD, EUR, CAD and GBP fiat accounts, access to compliant stablecoin payments, stablecoin to fiat cross border remittances, treasury management and yield products. Our focus has always been on giving businesses institutional grade tools without complexity."

Leadership rooted in practical innovation

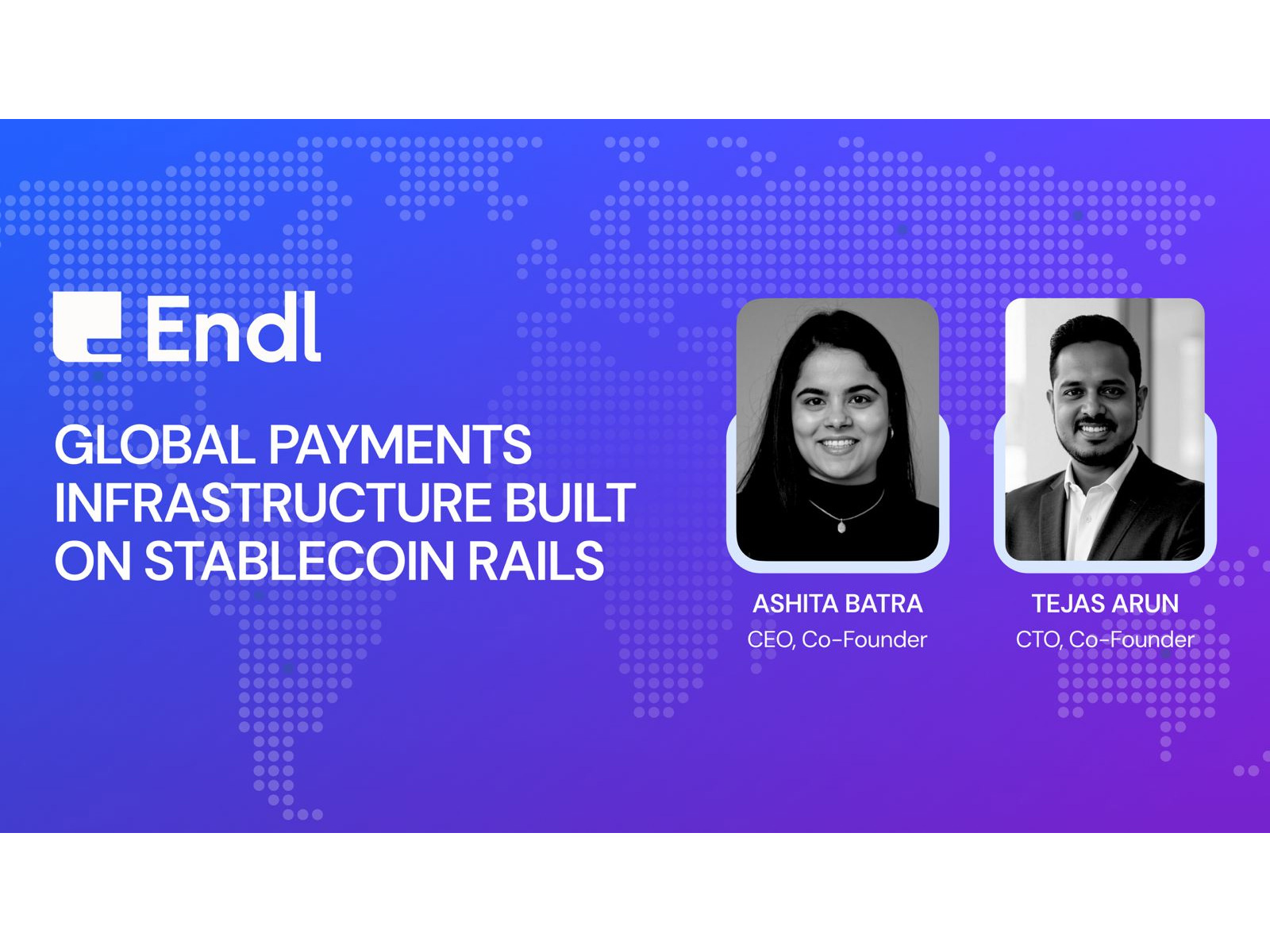

Endl is led by founders with deep experience in banking, payments, and financial technology.

Ashita Batra, Co Founder and Chief Executive Officer, brings a strong background in economics and digital finance. Her leadership philosophy centres on making global money movement intuitive and reliable for businesses that are often underserved by traditional banks.

Co Founder and Chief Technology Officer Tejas Arun leads the company's technology strategy, building scalable and secure infrastructure designed for multi market operations. Under his leadership, Endl supports multiple blockchain networks while ensuring enterprise grade security and compliance.

Together, the founders share a long term vision of rebuilding global financial infrastructure around speed, transparency, and accessibility.

This thinking is echoed in a recent company post, where Endl noted,

"Traditional banking was designed for a single nation and currency. Modern teams are global in scope, and Endl is moving the needle by making global business banking simpler with stablecoin efficiency and multi currency tools."

Solving a real problem in emerging markets

Across many emerging economies, businesses rely on informal peer to peer exchanges to convert stablecoins. These channels are often unreliable, unregulated, and exposed to operational and fraud risks.

Endl addresses this gap by offering a compliant alternative that does not require users to understand complex blockchain mechanics. Businesses can collect payments from clients in the United States and Europe, manage funds securely, and use their Endl Corporate Cards for day to day spending, travel, and digital services, all within a regulated framework.

This integrated approach reduces dependency on fragmented financial tools and enables smoother global operations.

Accelerating growth after fundraising

With the new capital, Endl plans to expand its product ecosystem, including enhancements to its corporate card program, advanced payout solutions, and deeper integrations with regulated financial partners. The company will also continue investing in compliance systems and regional partnerships to ensure sustainable growth. Its participation in programs such as 500 Global's Sanabil Accelerator and the XRPL Accelerator by Tenity reflects strong institutional confidence in its business model and leadership.

Building the future of borderless banking

Endl's long term vision is to create a comprehensive compliant banking suite around stablecoin wallets, cross border payment rails, and global corporate cards. The objective is to give businesses in emerging markets access to the same financial capabilities as enterprises in developed economies.

By combining regulatory discipline with digital asset innovation, Endl is shaping a new model of business banking, one where speed, security, and accessibility coexist. As cross border commerce continues to accelerate, Endl is positioning itself not just as a payments provider, but as a foundational partner for businesses navigating the digital economy.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)

Disclaimer: No Business Standard Journalist was involved in creation of this content

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 13 2026 | 1:41 PM IST