Master Direction part of Initiative for forex market risk management: Das

India's foreign reserves rise by $6 billion

)

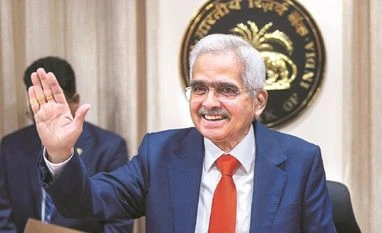

RBI Governor Shaktikanta Das

Listen to This Article

The issuance of the Master Direction for foreign exchange market participants is part of a comprehensive initiative to assist market participants in managing risks in the ever-changing market, RBI Governor Shaktikanta Das said in his monetary policy statement on Friday.

The rules guiding the management of foreign exchange risks through hedging underwent a thorough review in 2020, aiming to establish a principle-based system. Drawing insights from market participants' feedback and gained experience, the regulatory framework has been strengthened by consolidating guidelines for all transaction types—both over-the-counter (OTC) and exchange-traded—into a unified Master Direction. Additionally, improvements were made to enhance operational efficiency and facilitate access to foreign exchange derivatives, particularly for users with limited exposures. This refinement ensures a more flexible approach for a broader range of customers equipped with risk management expertise to efficiently handle their exposures.

Meanwhile, India’s foreign exchange reserves rose by $6 billion to $604 billion in the week ended December 1, the latest data by the Reserve Bank of India showed. This is the highest rise since July 14 of the current year.

The reserves crossed $600 billion after August 11.

The total reserves rose due to the rise in foreign currency assets which increased by $5 billion in the week.

The total reserves stood at $598 billion in the week ended November 24.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 08 2023 | 9:30 PM IST