Private power producer Tata Power faces concerns over its mining leases in Indonesia, as licences come for medium-term renewal. The company, however, has assured analysts there would be no material impact on its coal profitability.

“The coal mining contract of a relatively small Indonesian contractor (Tanito Harum, with 2-5 million tonnes per annum production) was revoked earlier this month. This has raised the perceived risk of a similar rejection for other coal producers with mining contracts coming up for renewal in the medium term,” analysts with JPMorgan wrote in a July 25 note on Tata Power.

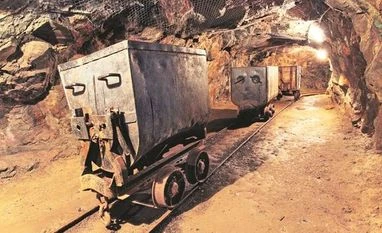

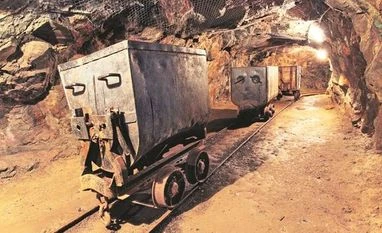

Tata Power, through its subsidiaries, holds 30 per cent stake in PT Kaltim Prima Coal and a 26 per cent stake in PT Baramulti Suksessarana Tbk mines in Indonesia. The company also signed an agreement to sell its 30 per cent stake in PT Arutmin Indonesia and associated companies in coal trading and infrastructure.

The licence for KPC expires in 2021. In its annual report for 2018-19, Tata Power said, “The renewal is under consideration by Indonesia.”

For the April-June 2019 quarter, Tata Power reported a net profit of Rs 249.94 crore, against Rs 1,768.78 crore in the same quarter a year ago. A 10 per cent decline in coal prices seen in the June quarter also lowered profit contribution from the Indonesian mines to Tata Power for the quarter under review.

While the fate of the Indonesian mining lease is not clear, Tata Power’s management has assured analysts the move will have minimal impact. “On the basis of the draft regulations under consideration, the management doesn’t expect any material impact within a 5 per cent range on its coal business profitability; however, in the interim, it remains a key uncertainty until it is cleared,” analysts with SBI Caps Securities wrote in an August 2 report on the company.

The analysts also added, “The Indonesian government is working on amending the existing regulation with likely changes in tax/royalty/value-added tax adjustments, among others, which is yet to be cleared by the new government that is expected by October this year.”

This is not the first time.

Tata Power will be dealing with changes in regulations in Indonesia. The Indonesian government, in early 2018, introduced a domestic market obligation scheme, which requires a local coal mining company to sell 25 per cent of its production to the domestic market at a fixed price of $70 per million tonne or the market rate, whichever is lower, to protect state-owned power plants against rising coal prices.

“This impacted the sale realisation of the mines, thereby impacting their profitability. The validity of the policy is till December 2019 and the Indonesian government will review the same thereafter,” Tata Power said in its 2019 annual report.

Kameswara Rao, partner, PwC, added, “The viability of competitively bid imported coal-based power plants is delicately balanced, and the profit in coal mining keeps power tariffs low. Any disruption to the supply chain can upset this equation.”

)

)