Agri commodity prices start upward move

Trend expected to continue due to fear of decline in output, coming after unseasonal rain affected crops

Dilip Kumar Jha Mumbai Prices of most agricultural commodities moved up in futures trading on the National Commodity & Derivatives Exchange, amid concerns of lower output in the ensuing kharif season on prediction of lower monsoon rain this year.

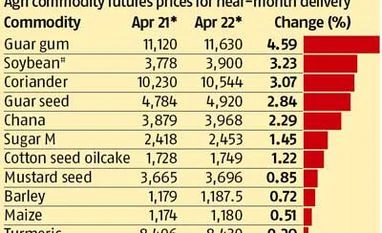

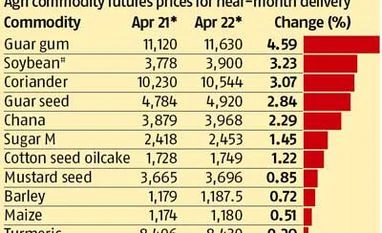

Soybean moved up 3.2 per cent to trade at Rs 3,900 a quintal. Chana and sugar rose 2.3 per cent and 1.45 per cent to quote at Rs 3,968 a qtl and 2,453 a qtl, respectively. Coriander and guar seed prices increased 3.1 per cent and 2.8 per cent to sell at Rs 10,544 a qtl and Rs 4,920 a qtl, respectively. The price rise is set to percolate into the spot market, too.

The India Meteorological Department (IMD) forecast the southwest monsoon to remain below the long period average (LPA) at 93 per cent this year, with a variation up to plus or minus five per cent. It has given three probabilities, of 28 per cent for a normal monsoon, 35 per cent for below normal and 33 per cent for a deficient one.

“The price rise is an immediate impact, which might start correcting. Logically, agri commodities’ prices should move up on fear of lower production. That did not happen last year, when rainfall was predicted at less. In fact, food price inflation came down this year despite lower production of foodgrain reported last year,” said Madan Sabnavis, chief economist, CARE Ratings.

At 88 per cent of the LPA, kharif foodgrain production was estimated 3.8 per cent lower at 123.78 million tonnes.

A second year of a weaker monsoon will decrease the efficacy of India’s irrigation system and hit agricultural output and farmers. Unseasonal rain since early March have already had a negative impact on many crops. A deficient monsoon will shave off 50 basis points from India’s GDP forecast of 7.9 per cent for 2015-16, says CRISIL.

Its report says: “There will be a chain reaction. Agriculture output will fall, causing farm incomes and rural demand to decline; there will be a spillover impact on industry from higher cost of agricultural inputs; government will be under pressure to increase the minimum support price (MSP, for crops), and food prices will turn volatile. Consumer Price Index inflation, where nearly 40 per cent weight is for agriculture-related products, could rise about 50 basis points above our current forecast of 5.8 per cent for fiscal 2016. That will mean the Reserve Bank of India’s inflation target of six per cent by March 31, 2016, gets breached in the very first year of adoption of the new monetary policy framework. Also, RBI will have less leeway to continue its current easing cycle.”

Earlier, Skymet Weather Services had forecast rainfall at 102 per cent of the LPA. The private sector forecaster likewise does not expect the dreaded El Niño condition to play out this year but climate researchers abroad are predicting an enhanced possibility in 2015. The condition, which typically occurs at irregular intervals of three to five years, weakens the Asian monsoon, often causing drought in northwest and central India and heavy rain (or even floods) in the northeast.

“If El Niño indeed plays out, it will be for a second straight year. And, this time, the impact on agricultural output will be greater compared with last year. El Niño conditions impact spatial distribution of rain, causing floods in some parts and drought in others. After last year’s weak monsoon, India’s northwest region has lesser capacity to withstand another inadequate spell of rains,” it added.

Prices of agri commodities have seen an upside which was restricted due to high inventory from last year. These have seen an upside due to unseasonal rain and hail. “We expect a further strong upside movement for agri commodities this year,” said Jayant Manglik, president (retail distribution), Religare Securities.

)

)