Market outlook: Goldman Sachs sets Nifty target of 11,600 for Dec 2018

Sees surge in global GDP growth benefitting global equities; expects RBI to hike rates next year

)

Explore Business Standard

Sees surge in global GDP growth benefitting global equities; expects RBI to hike rates next year

)

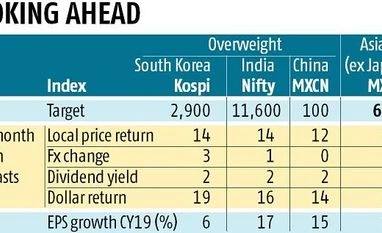

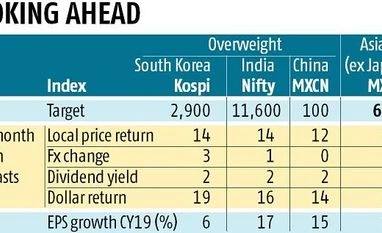

Goldman Sachs expects the healthy run in the global equity markets, including India, seen this year to continue in 2018 as well. The US-based brokerage expects the benchmark Nifty to climb to 11,600 by the end of the next calendar year, implying a 12 per cent upside from current levels. The forecast is impressive, considering the 50-share index has already rallied 28 per cent in the past one year.

Goldman Sachs estimates earnings growth of 18 per cent and 17 per cent in calendar years 2018 and 2019, respectively. “We expect solid earnings growth delivery in the next year and the following year. We see that as a credible backdrop for India to continue to perform,” said Timothy Moe, chief Asia Pacific equity strategist for Goldman Sachs.

India is among the three overweight markets (South Korea and China being the other two) for Goldman Sachs in the Asia Pacific (ex-Japan) region. “The underlying theme behind our overweight stance in these three markets is that we have strongest confidence in earnings being delivered for not only 2018, but also 2019,” said Moe.

The brokerage’s robust earnings growth forecasts are supported by its view that economic growth will accelerate globally and also in Asia. Goldman Sachs expects global economic growth to accelerate to four per cent in 2018, supported by fiscal stance of global central banks, easing of financial conditions and reduction in excess capacity leading to a pick-up in investment.

Andrew Tilton, chief Asia Pacific economist at Goldman Sachs, said India’s economic growth has been disappointing in the past few quarters due to one-time disruptions such as demonetisation and the goods and services tax (GST). “Absence of new disruptive events in 2018 will help revive growth,” he said.

Tilton said Goldman’s rate-hike forecasts by the US Federal Reserve and the Reserve Bank of India (RBI) is higher than consensus forecasts. Goldman expects the RBI to raise policy rates in 2018, ending the rate easing cycle.

Moe said India’s valuations relative to the MSCI Asia Pacific (ex-Japan) index are expensive and earnings growth will be the key to normalise the valuation.

The MSCI India index currently trades at 18.1 times its 12-month forward earnings estimate, one standard deviation above its long-term average of about 16 times.

Moe said there was room for higher capital inflows into India and other regional markets.

“Overseas investors are still over 500 basis points (bps) underweight on Asia ex-Japan relative to other regions. Even if they get back to average of last 10 years, that will be about 200 bps increase in holdings. This, on the base of $1.1 trillion of global regional funds’ assets, would be $25 billion of new inflows,” he said.

Moe said overseas investors have turned bullish on Indian equities after the government announced the bank recapitalisation programme. So far this month, overseas investors have bought shares worth nearly $3 billion.

He said a lot of global funds had reduced their overweight position on India over the past two years and overseas investors are no longer setting the tone for the Indian market.

“The domestic money is what is dictating the price now. It is no longer the FIIs (foreign institutional investors) who are the price-setters. Indian investors are much more in control of their own destiny. This is something everybody should be proud of,” he said.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Nov 28 2017 | 9:58 AM IST