Bank mergers: Changes that customers can expect

Loan rates will change at the next reset, while deposit rates will continue till maturity as the contract is binding on the bank

Priya NairThe country's largest bank, the State Bank of India, is considering merging its five associate banks and Bharat Mahila Bank with itself. While the merger will be good for customers because they will become part of a larger entity, the different rates of interest on loans and fixed deposits might be a worry for some. That is, if the existing bank is giving a higher rate of interest, will the rate go down after the merger?

In a merger, all assets and liabilities are taken over by the acquiring bank. This means all loans and deposits will be transferred to the latter's books of the bank that is acquiring, in this case, SBI. So, a borrower will now continue to pay his Equated Monthly Instalments to SBI, while a depositor will continue to get his interest from SBI, as loans and deposits are contracts, says Jehangir Gai, a consumer activist. "The contract says that it is applicable to the lender or its assignees (a person appointed to act for another). In this case, SBI would be the assignee. So, the same terms and conditions continue," he says.

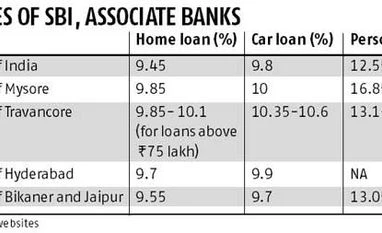

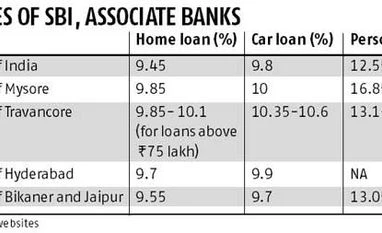

Loan and deposit rates All loans and deposits will continue at the original rates till the next reset date, says V G Kannan, managing director, Managing Director & group executive of associates & subsidiaries wing of SBI. In case of loans, the next reset date will depend on what the borrower has opted for under the Marginal Cost of Funds-based Lending Rate (MCLR). Loans that are linked to the Base Rate (BR) will be linked to SBI's Base Rate and those linked to MCLR will be linked to SBI's MCLR. Customers on BR will also get a choice if they want to shift to MCLR. "Currently SBI's associate banks offer higher rates because they are competing with other banks, including SBI," Kannan says.

At the end of a fixed rate tenure, should the lending rate of an existing loan be raised after a merger, customers are free to refinance the loan anywhere they can get a lower rate. Conversely, customers stand to gain if the merged entity reduces its lending rate, points out Adhil Shetty, chief executive officer, Bankbazaar.com.

As far as loans go, it will be beneficial to borrowers since SBI's rates are lower (see box).

Customers must do their cost-benefit analysis before shifting their loan. For instance, in case of a home loan, shifting to another bank could include additional charges such as processing fees, legal fees, technical fees, valuation fees, etc. If the interest rate of the new bank is higher even after taking into account all the additional charges only then does it make sense to shift.

Just like loans, fixed deposits (FDs) are contracts, too, and it is not possible for banks to change the rate mid-way. If you have locked into a long-term FD, say five years, you can continue with that till maturity. However exceptions may be made in case of high-value deposits, says Shetty, CEO, Bankbazaar.com.

If savings bank rates were different, then SBI would have to offer the same SB rates to customers of the associate banks too, points out Gaurav Gupta, CEO, Myloancare.in. After the merger of ING Vysya Bank with Kotak Mahindra Bank, customers of ING Vysya got six per cent on their SB accounts as that was the rate being offered by Kotak Mahindra Bank.

Card tie-ups and charges

Today many banks have tie-ups with various merchants and retail stores for offering discounts in the form of reward points or cash-back. What happens to these features after a merger? According to V N Kulkarni, an independent debt counsellor and former Bank of India official, most of these tie-ups are entered into for a certain period and it is most likely that they will continue till the end of that period. Once the validity is over then it is up to the new entity to continue with the tie-up or not.

The merged entity may enforce its own rules and charges in terms of debit card fees, features, minimum balance penalties, etc, says Shetty. "If past examples are anything to go by, the full transition from multiple entities to one may take anywhere from six to 12 months. Typically, banks reach out to customers to ensure a smooth transition," he adds.

Third-party products

Insurance or other third-party products sold through banks are primarily serviced by the manufacturer of the product (insurance, mutual funds, etc). All contracts are directly executed between the customers and the manufacturer of the product and so there is no impact on customer service or efficiency of the product. "The customer is free to reach the manufacturer and vice versa. Also, all the customers' rights are spelt in the contracts. In simple terms the customer is not privy to the arrangement between the bank and such other parties and as such his rights and the other party's service obligations shall not be affected," says Shetty.

Some other changes that customers have to keep in mind include getting new cheque books with name of the new bank; issuing fresh standing instructions for payments through Electronic Clearing Services (ECS) such as payment for electricity or other utility payments; changing the account number linked to your Demat account, etc.

)

)