With the merger exercise of three public sector general insurance companies —National Insurance, United India Insurance and Oriental Insurance — going slow, vacancies are piling up.

According to rough estimates, in the officers’ grade alone, close to 600-900 posts are vacant since the last one year. At the clerical and subordinate level, the staff shortage is around 12,000, said sources in the companies.

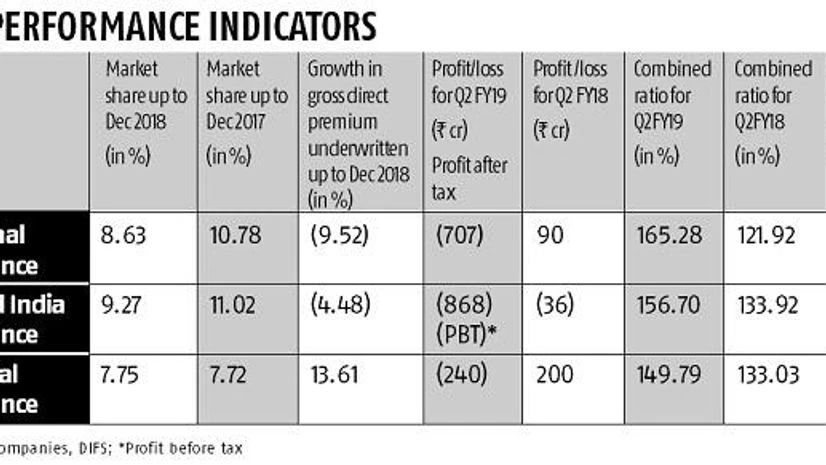

The impact is already telling on the financial performance of the companies. In addition, at least two firms — National Insurance and United India Insurance — significantly lost market share.

While National lost market share from 10.78

)