CBDT's decision to not pursue cases below Rs 2 mn may cost govt Rs 100 bn

I-T dept can now concentrate on fewer but larger cases

)

premium

Last Updated : Jul 25 2018 | 7:00 AM IST

The Central Board of Direct Taxes’ (CBDT’s) decision to not pursue pending cases of income tax (I-T) demand below Rs 2 million could deprive the exchequer of potential revenues of over Rs 100 billion, according to a senior tax official.

Going by the new rule, the tax department will have to withdraw 90,536 appeals pending before the Income Tax Appellate Tribunal (ITAT) and various high courts. The government’s objective behind changing the monetary limits for appeal is to reduce litigation by 50 per cent and allow the I-T department to focus on fewer but more important cases to recover taxes, said the official.

The new monetary limits for tax authorities to file appeals in the ITAT, high courts, and the Supreme Court are Rs 2 million, Rs 5 million and Rs 10 million, respectively, as against the earlier limits of Rs 1 million, Rs 2.5 million and Rs 5 million.

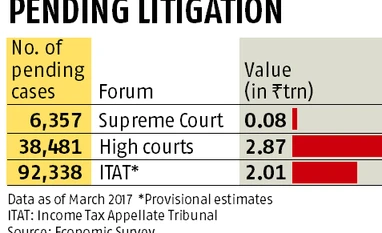

According to the Economic Survey 2017-18, there were 137,176 direct tax cases, valued at around Rs 5 trillion, pending in the ITAT, high courts and the Supreme Court as of March 2017. “Just 0.2 per cent of these cases constituted nearly 56 per cent of the total demand value, and 66 per cent of the pending cases each less than Rs 1 million in claim amount added up to a mere 1.8 per cent of the total locked-up value of the pending cases,” said the Survey.

The data on pending cases of demand value between Rs 1 million and Rs 2 million is not available. However, officials say the numbers will be reasonably large. “The locked-up value works out to Rs 90 billion in cases below Rs 1 million, and with the threshold rising to Rs 2 million, it will be fair to estimate the exchequer’s loss at over Rs 100 billion,” said the official cited above.

The success rate of the I-T department at all the three levels of appeals is less than 30 per cent. Over a period, this rate has been declining while the number of cases is increasing. Of these, the I-T department has initiated 85 per cent of the cases, according to the Economic Survey 2017-18.

Another tax official said the decision might impact the litigation amount stuck for years but would help the government achieve the objective of providing certainty to taxpayers. The high volume of litigation has not only resulted in a large amount of money remaining unrealised, but also sends a wrong impression to global investors who may want to invest in India.

Other than the various tribunals, there are a large number of cases pending at the commissioner level too. To tackle this, the CBDT in its action plan provided concrete steps and targets to commissioners for disposal of cases. According to the plan, a commissioner must dispose of 25 per cent of appeals involving demands of Rs 1 million and above during the current fiscal year.

At least 90 per cent of appeals that involve demand of less than Rs 2 million and 70 per cent of cases where demand of less than Rs 1 million should be disposed of this fiscal year.

According to the I-T data, there are 195,884 appeals, worth over Rs 40 billion, pending before the Commissioner of Income Tax (CIT). Of these, 115,706 appeals had tax demand of less than Rs 200,000 pending as on April 2018.

According to the CBDT, high priority should be given to appeals involving demand of less than Rs 200,000. The next priority should be given to disposal of appeals involving demand of Rs 1 million and above.

“A two-pronged strategy with slight modifications to deepen the impact shall be adopted this year, having proportionate focus on optimising disposal in terms of numbers and on maximising disposal of appeals involving high quantum of demand,” the CBDT emphasised.

The tax department goes for an appeal based on the limit set on the “tax effect”, which is the difference between the tax on income determined by the department and the tax calculated by the taxpayer.

There are a number of other suggestions that the CBDT is working on. The mechanism for advance ruling could be strengthened and a high court cell could be set up in each jurisdiction to fast-track appeals. Besides, more specialised benches at all judicial levels are being planned. These cells will be responsible for tracking court orders on a daily basis and compiling information on cases.