Here's why stressed power accounts are unlikely to impact SBI numbers

With provision coverage ratio satisfactory, credit cost expected to stay within earlier forecast levels, feel analysts

)

With the Allahabad High Court not providing any relief on stressed power loans that are impacted by the Reserve Bank of India's (RBI's) February 12 order, one might have expected it would impact the share price of public sector banks (PSBs).

On Monday, the Bank Nifty had risen 1.5 per cent on hope that the court would provide relief. However, despite the lack of interim relief, the index fell only 0.3 per cent in Tuesday's trade.

There are concerns that most PSBs and corporate-focused private banks would need to make additional provision for these loans. The action deadline for RBI's order ended on Monday and this would hit banks' power accounts.

Even so, the impact for State Bank of India (SBI), the largest lender, is unlikely to be significant. The share price, though down one per cent at Rs 305 on Tuesday, was still higher than last week's closing price of Rs 300.

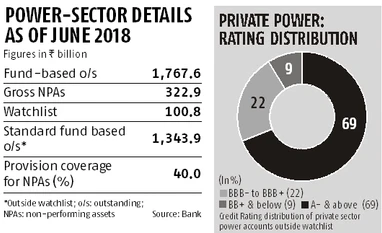

For the sector, the degree of provisioning and capital impact will vary, depending on the provisioning in place, credit ratings of assets, etc. On SBI, analysts say a satisfactory provision cover provides a cushion. It has already provided about 75 per cent for all corporate non-performing assets (NPAs or bad loans). And, has 40 per cent provision coverage for power sector NPAs.

Many experts expect write-offs (a haircut is a term) on power sector loans to be high. SBI has already factored in the additional pain, assuming a 50 per cent haircut.

SBI has 40 per cent provision coverage for power sector NPAs. Additional upfront provisions required for resolution of power accounts have already been factored in the credit cost guidance (forecast) of around two per cent for 2018-19. For the accounts which will be referred (for insolvency proceedings) to the National Company Law Tribunal, banks will get one year to provide for these. So, there will not be a major impact on SBI's financials," says Asutosh Mishra, analyst at Reliance Securities.

SBI chairman, Rajneesh Kumar says so, too, that there will be no additional impact in terms of provisioning and NPAs.

Some do not rule out higher than expected pain. "This is a significant event, which might see about 60 per cent likely haircuts for SBI, and some accounts slipping from the watch list, too, adding to the pain in the near term," says Lalitabh Srivastava, assistant vice-president at brokerage Sharekhan.

However, he believes several positives are also aligning for SBI, to help offset the impact. "At present we are not revising our credit cost estimates for FY19 for SBI, considering its healthy provision coverage, and improving NPA movement trajectory. We expect credit cost for FY19 to remain within the guided levels," he added.

More, the stake sale by SBI in its general insurance arm by the end of 2019 will provide profitability support, with expected proceeds of Rs 17-18 billion. An analyst at Emkay believes SBI can sell 15-16 per cent stake in SBI General Insurance and the valuation would be around 25 times the trailing 12-month earnings, less than the only listed player (ICICI Lombard).

Further relief also stems from the fact that 63 per cent of the bank's power sector accounts (outside of its watchlist), amounting to about Rs 1.3 trillion, is of the public sector. These are relatively in a better position and typically are backed by government guarantee. And, the major part of the private power sector accounts have a credit rating of BBB or above), indicating low default probability.

However, the liquidation of power sector accounts that have turned NPAs will need to be watched. How fast the banks can move and they recover would provide further triggers.