Investors bet on small finance banks as financial inclusion makes way

High growth, certainty of exits attract PE firms

)

premium

Last Updated : Aug 01 2018 | 10:54 PM IST

As financial inclusion makes deep inroads into India, private equity players are taking big exposures in small finance banks as they see these new-age banks to be the largest beneficiaries of this inclusion.

Besides the prospect of huge gains, ease of exit is another factor driving the interest of large players.

According to data compiled by Venture Intelligence, around $800 million has been pumped into various small finance banks since September 2015.

In a bid to promote financial inclusion by catering to the financing needs of small and micro enterprises and people at the bottom of the pyramid, the Reserve Bank of India gave licences to 10 entities in September 2015 to operate as small finance banks. Many entities with microfinance lineage such as Ujjivan, Jana Small Finance bank, Equitas, Fincare and Suryoday, among others, received licenses to operate in this space.

The licensing guidelines released by the RBI also made it mandatory for these small finance banks to list their shares in exchanges within three years after reaching a net worth of Rs 5 billion.

Industry insiders are of the opinion that business growth opportunities along with certainty of exits have made the small banking finance space attractive.

“Many microfinance institutions (MFIs) have received small finance banking licence. This transformation will now enable these companies to reduce their cost of funds due to the deposits base. So, we see a lot of value in these firms. Apart from this, many of these firms are strong regional players,” India head of a global PE major said.

It's the reason why global PE majors like TA Associates, TPG, Morgan Stanley, Singapore state investment arm-Temasek, Warburg Pincus and LeapFrog Investments are optimistic about the growth opportunities in the small finance banking space and infused huge amounts of money into these firms.

For example, Singapore state investment arm Temasek struck a deal in June this year to invest Rs 10 billion ($147 million) in AU Small Finance Bank and will acquire 4.8 per cent stake in the entity.

Similarly, Janalakshmi Financial Services had raised around $100 million ahead of its transformation as a small finance bank from HarbourVest and other investors.

In September last year, the financial institution raised around Rs 10.30 billion (around $150 million) from global PE major TPG along with Treeline, a Morgan Stanley Asia-managed PE fund, and QRG Enterprises among others.

“We have raised around Rs 16 billion from a clutch of investors in the recent past and another Rs 3 billion will be added to our capital base after RBI approval,” Ajay Kanwal, CEO of Jana Small Finance Bank, had said.

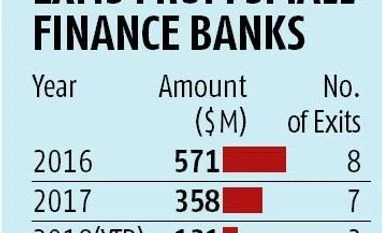

Meanwhile, listing of small finance banks in exchanges had given a good opportunity to PE investors to exit from these entities completely or at least opt for a partial exit within last three years. Data compiled by Venture Intelligence showed that 18 exit deals had been executed by PE players in the last two and half years.

The biggest exit of $247 million was by Warburg Pincus, IFC, ChrysCapital and Kedaara Capital from AU Small Finance Bank in July last year. Similarly, IFC exited from the same entity in July this year at an amount of $111 million.

As financial inclusion makes deep inroads into India