MFIs want Rs 3 lakh as loan cut-off to widen scope of eligible borrowers

If the RBI agrees to this suggestion, 50 million MFI customers will join the current net of 60 million and an outstanding portfolio of Rs 2.45 trillion

)

premium

The move shall align the threshold to the definition for the ‘economically backward class’ under the Pradhan Mantri Awas Yojana

5 min read Last Updated : Dec 13 2021 | 2:05 AM IST

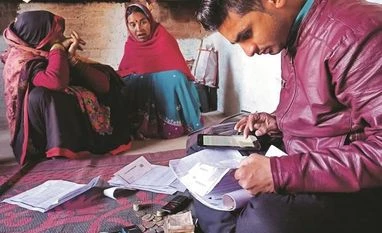

Micro-finance institutions (MFIs) want the Reserve Bank of India (RBI) to hike the qualifying threshold of inflation-adjusted household income for taking loans to Rs 3 lakh a year to widen the scope of eligible borrowers.

If the RBI agrees to this suggestion, 50 million MFI customers will join the current net of 60 million and an outstanding portfolio of Rs 2.45 trillion.

The development comes even as the banking regulator is in the final stages of issuing operational guidelines on the basis of the feedback to its “Consultative Document on Regulation of Microfinance”, released in June this year.

The document had proposed a household income threshold of Rs 1.25 lakh for rural and Rs 2 lakh for semi-urban and urban areas for identifying a microfinance borrower.

The MFI sector, which has been in discussion with the central bank, is of the view that a better approach would be to do away with rural and urban differentiation and the threshold could be upped to Rs 3 lakh per annum and align it to the definition of the “economically backward class” under the Pradhan Mantri Awas Yojana. This, it is felt, “will help as being the maximum limit and will include more needy clients, and, in any case, past experience shows that majority of clients serviced are below the maximum income limit”.

A case is also being made to include loans under the self-help group (SHG)-bank linkage model and co-operatives within the definition of microfinance, and to clarify the applicability of the definition to these two major sources of credit because the borrower base is mostly the same.

The move to seek a revision in the household income threshold is critical, given the residual stress due to the pandemic.

A top official of a leading MFI said the need for a revision should also be seen in the context of the Centre’s move to seek an additional Rs 25,000 crore in supplementary funding for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). “The MFI business sits adjacent to the MGNREGA. A good portion of MGNREGA beneficiaries avail themselves of MFI loans as well.” The point being made here is that revising the income threshold will help MFIs add more borrowers at the bottom of the economic pyramid.

MFI industry sources are of the view that the main issue with the qualifying criterion is that the income threshold (last revised through a circular on November 8, 2019) is “a static benchmark and it does not factor in inflation and may lead to excluding several needy households”. It is debatable if there should be a differentiation at all for such thresholds based on geography, given the migration of workers across states. Another concern is that both the income thresholds (Rs 1.25 lakh for rural and Rs 2 lakh for semi-urban and urban areas) are “the maximum rather than minimum; and, therefore, excludes many potential borrowers”.

IN THE WORKS

- A higher household income threshold can help add 50 million new MFI customers to the existing base of 60 million, and an outstanding portfolio of Rs 2.45 trillion

- The move shall align the threshold to the definition for the ‘economically backward class’ under the Pradhan Mantri Awas Yojana

- A related move is to make uniform reporting by all regulated entities to credit bureaus (CBs). Currently, MFI-NBFCs report on a weekly basis to CBs but banks do it on a monthly basis

- The RBI is the final stages of issuing operational guidelines based on the feedback received to its ‘Consultative Document on Regulation of Microfinance’

The RBI’s consultative document had referred to the fact that “it is often difficult to objectively evaluate an individual’s income in a predominantly cash economy”. Also, microfinance loans are often provided to women borrowers who may not have significant income individually.

The “Committee on Comprehensive Financial Services for Small Businesses and Low-Income Households” had also recommended assessment at household level rather than individual level for low-income households. It pointed out that for identifying a household, the definition will be derived from what is used by the National Sample Survey Office -- a group of persons normally living together and sharing a common kitchen. Even though the determination of the composition of a household will be left to its head, greater emphasis should, however, be placed on “normally living together” rather than on “ordinarily taking food from a common kitchen”.

A cash-driven economy, too, makes it difficult to make a correct assessment of household income. “There is scope for innovation in income assessment to arrive at a more accurate client profiling. In view of the above, it would not be desirable to prescribe a single criterion for household income assessment”, the paper had noted.

Given the criticality of proper household income assessment and difficulties in providing a common formula, it is suggested that all regulatory entities have a board-approved policy for assessing this.

A related move is for all players in the micro-finance business to report borrowers’ data to credit bureaus (CBs) uniformly and in a timely manner. Currently MFI-NBFCs report on a weekly basis to CBs, but banks do it once a month.