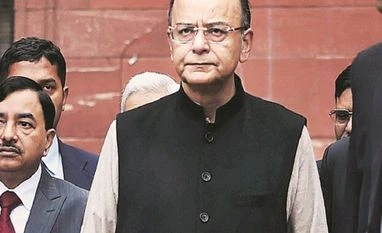

He maintained that the RBI board applied its mind “independently” and recommended demonetisation to the government.

The finance minister (FM) also said the RBI was working to fix the marginal discount charges for debit card transactions above Rs 2,000. But credit cards might not get such rules as that would depend on issuer and also because the economically well-off mostly use these cards. “I was told that till about two months ago, approximately 75 crore (750 million) cards were in circulation, of which about 72 crore (72 million) were debit cards and not credit cards.”

The RBI approved the design for the new notes in May, he said. Eight of the 10 RBI directors were present at a November 8 meeting before the government got an independent final recommendation on demonetisation.

RBI board had, in May 2016, decided to approve the design of the new notes, he said, replying to questions in the Rajya Sabha during the Question Hour. “Thereafter a series of meetings used to be held periodically, at times on a defined day once a week, where the seniors in RBI as also in the government were in consultation. Because the decision had to be kept in utmost secrecy, it is for this particular reason that these were not put in public domain.”

The FM said RBI had started printing the new currency notes in advance and had adequate currency available. But it was the process of recalibration of ATMs that took time. Recalibration could not be done in advance for reasons of secrecy, he said.

Jaitley said a formal proposal to RBI to consider this matter was sent by the finance ministry and RBI board independently considered and accordingly made the recommendations.

The FM said merchants try to transfer the service charge to the customer, but there were newer technologies available that were being offered free. “When the ‘charge-free’ offer is available to the customer itself, then the customer has the option in a market-economy really to go in for the cheaper instruments rather than to go in for something which will cost him greater money,” he said.

)