NBFCs go deep into commercial loan territory

The sector is also witnessing some pressure in its asset quality as economy contracts

)

premium

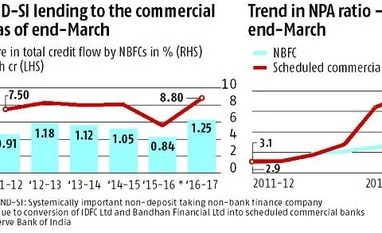

Non-banking finance companies (NBFCs) are emerging as major lenders to the commercial sector. While the absolute size of their loan book to the corporate sector is still much lower than of banks, the incremental lending is higher than banks. The sector, already the third-largest in the financial system, after banks and insurance companies, is also witnessing some pressure in its asset quality as economy contracts. Nevertheless, the asset quality of these lenders are still much better than that of commercial banks, according to a study by the Reserve Bank of India (RBI). While bank credit grew at 5.1 per cent at the end of March 2016-17, NBFCs registered credit growth of 13 per cent. There are eight kinds of NBFCs in the system, engaged in doing microfinance to giving loans for large projects. At a time banks are shying away from lending to the corporate sector, NBFC loans to the commercial sector has reached eight per cent of gross domestic product in FY17, the RBI study said.