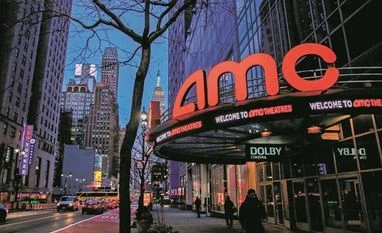

The remarkable surge in shares of AMC Entertainment Holdings and a handful of other stocks is showing up in multiple exchange-traded funds, skewing portfolios, altering risk profiles and exerting outsized influence on prices.

Take the $68 billion iShares Russell 2000 ETF (ticker IWM). In the past week through Thursday, AMC powered 70 per cent of the product’s advance. The stock was responsible for less than a 10th of the fund’s return in the previous week.

It’s a timely reminder that even diversified funds on autopilot remain subject to the whims and eccentricities that frequently lash markets out of nowhere.

“For index investing, the appeal is that human decision-making, human emotions are taken out of it,” said Tom Essaye, a former Merrill Lynch trader who founded “the Sevens Report” newsletter. “That works all well and good until a stock that is supposed to be 50 basis points of the fund now becomes 6 per cent.”

The AMC effect can be seen across a range of funds. Alongside IWM, the $17.5 billion iShares Russell 2000 Value ETF (IWN) and $72 billion iShares Core S&P Small-Cap ETF (IJR) have also seen the stock’s influence climb.

A similar phenomenon took place in January, when GameStop at one point surged more than 1,600 per cent. Shares of the video-game retailer also rallied alongside AMC in the past week. The two companies are among a handful of shares dubbed meme stocks that are enjoying rapid, social-media fueled gains.

“Once the rules have been drawn up in the land of indexing, once the play has been called in the huddle, you don’t have that discretion,” said Ben Johnson, Morningstar’s global director of ETF research. “You take whatever the market is going to give you and execute the plays.”

The difference now is that investors have poured billions of dollars into products tracking smaller and cheaper stocks in the past six months, part of a broad rotation into more growth-sensitive companies to ride an economic recovery from Covid-19.

At the same time, meme mania is bigger than ever. Alongside AMC and GameStop, companies including BlackBerry, Koss and Bed Bath & Beyond also saw huge moves in the past week.

“Even in a basket of 2,000 stocks you’re getting some systemic risk around this concept of retail meme stocks because they’re small enough to push around,” said Nick Colas, co-founder of DataTrek Research.

Balancing act

The cash and chaos exposes a glitch in the plumbing of many funds, which is that they’re often tied to the rebalancing schedule of the index they follow.

Given the speed of the rallies in the likes of AMC and GameStop, even tracking an index that rebalances quarterly — a relatively frequent schedule, by industry standards — leaves a fund susceptible to distortion.

One of the most-dramatic examples occurred in May, though it was unrelated to the meme-fueled drama. Around 68 per cent of the $14.5 billion iShares MSCI USA Momentum Factor ETF (MTUM) had to be changed because of the huge market rotation that occurred since its last semiannual rebalance.

)