Home / World News / Masayoshi Son may be less of a technology guru, more a die-hard capitalist

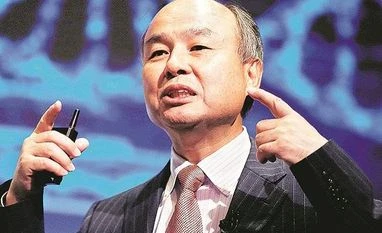

Masayoshi Son may be less of a technology guru, more a die-hard capitalist

With the Vision Fund fully deployed, and the second iteration likely a lot smaller, Son may have trouble offloading his startup stakes

)

premium

5 min read Last Updated : Dec 23 2019 | 8:18 AM IST

This is the year that brought a $100 billion venture capitalist to his knees.

In January, SoftBank Group Corp’s Masayoshi Son was riding high, writing billion-dollar checks to unicorns from office-sharing startup WeWork to autonomous-delivery vehicle designer Nuro. But as 2019 winds down, the Japanese dealmaker is straining to finance a $9.5 billion bailout package for Adam Neumann’s troubled startup, whose valuation has evaporated from $47 billion to $8 billion — or even zero, depending whom you ask.

SoftBank’s bad year goes well beyond WeWork. Investors are starting to get the feeling that whatever Son brings to the public is troubled. And you don’t need to look far for proof: Shares of Uber Technologies Inc. and Slack Technologies Inc., both backed by the Vision Fund, tumbled upon listing. To venture funds that rely on IPOs for exits and profit, this dark suspicion is a kiss of death.

So how did the world fall out of love with Masa Son?

Over the past three years, Son has deployed his giant war chest aggressively, threatening to back a startup’s rival if founders refuse his money, or investing in competitors and forcing them to merge. These unsavory tactics only became more bothersome when much-hyped SoftBank-backed IPOs started failing. Now we’re coming to realize that Son is less a technology guru than a die-hard capitalist, reinventing the 19th-century business model by squeezing workers for a bit of extra profit.

Take a look at the Vision Fund’s portfolio. Rather than investing in hard tech such as AI or chip design, a whopping 40% has been funneled into transportation and logistics companies such as Uber and its ride-hailing clones around the world. You can be sure that drivers on the streets of Shanghai and Jakarta don’t get insurance or pension benefits; they’re only paid per ride. This contract culture seeps well beyond delivery, too: India’s lodging chain Oyo Hotels and Homes, for instance, is asking mom-and-pop business owners to absorb big fixed costs upfront, a New York Times investigation found.

But we are living in the 21st century, when human capital ought to be worth something and worker protests have erupted around the world. In China alone, three SoftBank-backed unicorns faced 32 strikes last year. So it’s just a matter of time before governments start to step in, demanding better labor protection. If you buy into Karl Marx’s view that a business’s profit pie is a zero-sum divide between workers and capitalists, Son’s portion will inevitably shrink. Put another way, the path to profitability for many of his unicorns will be long and winding — or may even lead to a dead end.

There’s nothing inherently wrong with being a capitalist, except that SoftBank’s capital is really debt. As I’ve written throughout the year, the company is junk-rated for a good reason: It’s cash poor. Subsidiaries from Sprint Corp. to British chip designer ARM Holdings Inc. don’t put much on the table, so SoftBank has to live off the cash on hand, borrow even more, or sell its investments to the Vision Fund. At the holding level, Son’s company has already amassed 4.5 trillion yen ($41 billion) of interest-bearing net debt.

For now, SoftBank is running like a well-oiled machine. But with the Vision Fund fully deployed, and the second iteration likely a lot smaller, Son may have trouble offloading his startup stakes. To make matters worse, he has folded WeWork under the SoftBank umbrella. Beyond footing the bill for a bailout, SoftBank will need to figure out how to finance the office-leasing company’s $47 billion in lease liabilities. By now, Japanese bankers, who for years revered Son and relied on him for banking fees, are having second thoughts.

There’s even a case to be made that Son isn’t a terribly skilled capitalist. By September, his Vision Fund had made $11.4 billion, mostly in paper profit, on $76.3 billion in investments deployed over two years. Tiger Global Management, another active investor in late-stage unicorns, has a much better track record. Hedge funds — passive yet nimble investors — are all about due diligence and may well be savvier than Son, who has a habit of writing eye-popping checks after 10 minutes of face time.

If there’s anything Son is unshakably good at, it’s financial engineering. Even after a bailout, WeWork’s debt pile somehow won’t show up on SoftBank’s balance sheet: While the parent will have an 80% stake, it won’t hold a majority of voting rights, the company argued. Another example of such wizardry is SoftBank's investment playbook. If it buys shares in a startup and then puts in more money at a higher valuation, it claims to have made a profit. In the June quarter, it booked $3.8 billion in unrealized gains, partly because of a series of investments in Oyo.

Of that $11.4 billion capital gain the Vision Fund has booked, just about $4 billion is realized, and from only two deals — the sales of Indian e-commerce company Flipkart Online Services Pvt to Amazon.com Inc. and well-timed trades in Nvidia Corp. But then Son has always been quick to writeup and reluctant to writedown. After all, in private markets, fair-value accounting is a rigged game.

Going into the next decade, Son will eventually have to show his cards. There are many expensive decacorns in his incubator. From Bytedance Inc. to Didi Chuxing Inc., these unicorns with a $10-billion-plus valuation would easily be considered large caps in public markets. When they do list, we’ll quickly find out if Son is indeed a visionary, or just a mediocre capitalist with “too much money” and a lot of mistakes.

Topics : SoftBank Masayoshi Son