Foreign portfolio investors (FPIs) have been net buyers in the last five sessions and domestic institutions are also net positive. Breadth remains negative, with advancing stocks outnumbered by declining stocks. Volatility remains quite high. A move above the 200-DMA means that it should be a good zone of support- it's currently in the Nifty 10,750-10,800 zone. The rupee has recovered to below Rs71 to the dollar.

Corporate results just about met expectations and the GDP numbers are disappointing. The key factors for revival are the lower crude prices and a stronger rupee. The US-China trade war continues but the two nations are still negotiating. The next major news event that will influence the market is the RBI Monetary Policy Review and that will be followed by state assembly results this weekend.

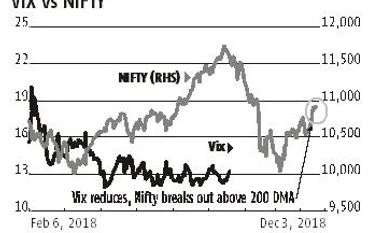

The Nifty hit its all-time high of 11,760 in late August and retracted to a low of 10,005. A rebound above 10,900 is definitely a positive signal even though it's not backed by breadth. The Vix continues to run high, indicating fear is there, but it has pulled back slightly in the last five sessions.

An eight-week downtrend led to 14.9 per cent retraction off the peak, before the continuing six-week rebound. There were high volumes when the Nifty was last in the 10,900 zone and there will be a lot of selling pressure to absorb.

For sustainable bullishness, the index must beat 11,000. News flow will be critical. A hawkish RBI review which is definitely (not expected) would be a deal-breaker for bulls. So would poor performances by the BJP in the state elections.

The Bank Nifty bottomed at 24,400. The pullback has now gone to 26,900-plus. A long December 27, 26,000p (196) and a long 28,000c (126) can be offset with a short December 13, 26,000p (51), short 28,000c (99). Net cost is 172. There could be a huge payoff if either breakeven is crossed at approximately 25,825, 28,175. That would require three big trending sessions. Volatility is likely to remain high.

The Nifty is at 10,883. A long 11,100c (107), short 11,200c (72) costs 35, and pays a maximum 65. A long 10,700p (117), short 10,600p (91) costs 26, and pays a maximum of 74. These are quite distant from money. The combination cost 61, with break evens at 11,161, 10,639.

)