Jindal Stainless, Jindal Stainless (Hisar) rally up to 35% in 3 days

The government has issued an order to levy provisional countervailing duty on certain types of flat stainless products for a period of four months

)

premium

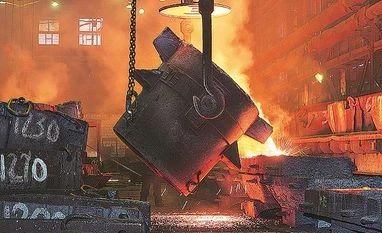

Shares of iron & steel products companies were in focus at the bourses with Jindal Stainless and Jindal Stainless (Hisar) rallying up to 35 per cent in the past three days after the government imposed provisional countervailing duty (CVD) on stainless steel flat products imported from Indonesia.

Jindal Stainless hit a 52-week high of Rs 58.25, after surging 10 per cent on the BSE in an otherwise weak market on Wednesday. In the past three days, the stock has zoomed 35 per cent from the level of Rs 43.25, hit on October 9.

“It is pertinent to note that Ministry of Finance, Government of India vide notification dated October 9, 2020, based on the findings of Directorate general of Trade Remedies, issued an order to levy provisional countervailing duty on certain types of flat stainless products for a period of four months,” Jindal Stainless said in exchange filing on clarification on increase in volumes.

The increase in volume of scrip of the Company in recent past is absolutely market driven and we have no comments on the same, it said.

Jindal Stainless hit a 52-week high of Rs 58.25, after surging 10 per cent on the BSE in an otherwise weak market on Wednesday. In the past three days, the stock has zoomed 35 per cent from the level of Rs 43.25, hit on October 9.

“It is pertinent to note that Ministry of Finance, Government of India vide notification dated October 9, 2020, based on the findings of Directorate general of Trade Remedies, issued an order to levy provisional countervailing duty on certain types of flat stainless products for a period of four months,” Jindal Stainless said in exchange filing on clarification on increase in volumes.

The increase in volume of scrip of the Company in recent past is absolutely market driven and we have no comments on the same, it said.

Topics : Jindal Stainless Buzzing stocks Markets