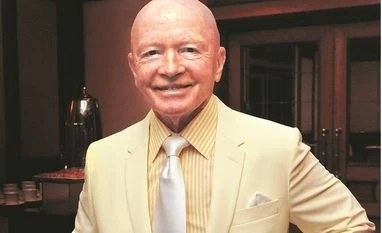

Mark Mobius sees more pain ahead for emerging markets

The MSCI Emerging Markets Index of shares has fallen around 11 per cent from a 10-year high in late January

)

premium

Even the normally bullish Mark Mobius says there's worse to come for emerging markets. There's a danger of contagion from the deteriorating situation in Turkey, and Argentina and Brazil aren't doing well, said the veteran developing-nation investor, who left Franklin Templeton Investments earlier this year and set up Mobius Capital Partners LLP. "We still could have some downside in the emerging markets," Mobius said in a Bloomberg TV interview with Haslinda Amin and David Ingles. “But selectively, you have some good opportunities. Now would be a stock picker's market.”