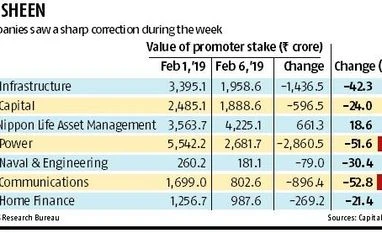

Mutual Funds' collateral declines as shares of ADAG companies tank

Franklin Templeton, Indiabulls MF & DHFL Pramerica MF have Rs 1,418-cr exposure

)

premium

Mutual funds (MFs) led by Franklin Templeton, which has the highest exposure of Rs 1,244 crore through its debt schemes in the promoter entities of Anil Ambani group companies, will have to either seek higher collateral by way of topping-up of shares from promoter entities or risk lowering values of their schemes.

According to data from Value Research, mutual funds’ exposure to the debt papers of Anil Ambani’s Reliance group’s promoter entities — Reliance Infrastructure Consulting & Engineers, Reliance Big Entertainment and Reliance Big — stood at Rs 1,418 crore as on December 31, 2018.

These Reliance group companies had borrowed by putting group firms’ listed shares as collateral.

The share prices of Reliance Infrastructure fell by 32 per cent on Wednesday in which promoter entities hold almost half of the equity. Of this, 84 per cent of the stake is pledged to funds and lenders. Similarly, other group companies’ shares also declined, sending a wake-up call to mutual funds.

An e-mail sent to Reliance group seeking a comment did not elicit any response.

“The cash top-up available in these transactions was used to reduce outstanding exposure and the transactions remain adequately covered. We continue to engage with the company,” a Franklin Templeton spokesperson said. According to sources, Indiabulls MF this week used the cash top-up available to reduce its outstanding exposures to Rs 14 crore from Rs 25 crore.

According to data from Value Research, mutual funds’ exposure to the debt papers of Anil Ambani’s Reliance group’s promoter entities — Reliance Infrastructure Consulting & Engineers, Reliance Big Entertainment and Reliance Big — stood at Rs 1,418 crore as on December 31, 2018.

These Reliance group companies had borrowed by putting group firms’ listed shares as collateral.

The share prices of Reliance Infrastructure fell by 32 per cent on Wednesday in which promoter entities hold almost half of the equity. Of this, 84 per cent of the stake is pledged to funds and lenders. Similarly, other group companies’ shares also declined, sending a wake-up call to mutual funds.

An e-mail sent to Reliance group seeking a comment did not elicit any response.

“The cash top-up available in these transactions was used to reduce outstanding exposure and the transactions remain adequately covered. We continue to engage with the company,” a Franklin Templeton spokesperson said. According to sources, Indiabulls MF this week used the cash top-up available to reduce its outstanding exposures to Rs 14 crore from Rs 25 crore.