Sovereign funds cut India investments; share of FPI drops in recent years

Mutual funds saw net inflows of Rs 82.4 billion in June 2018, according to data from the Association of Mutual Funds in India, including inflows into arbitrage funds and tax-saving equity schemes

)

premium

Some of India’s largest foreign investors are showing signs of increasing reticence.

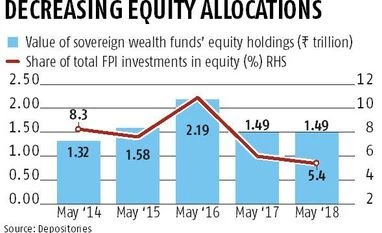

Sovereign wealth funds’ stock market bets were worth Rs 1.5 trillion, according to latest depository data as of May 2018. This is lower than the previous year, and reflects half-a-trillion drop from two years ago.

Meanwhile, overall foreign portfolio investments rose by over Rs 7.4 trillion from May 2016. Sovereign wealth funds’ share of foreign investments has dropped to 5.4 per cent in May 2018 from 10.9 per cent share in May 2016.

A sovereign wealth fund is owned by the government. It accumulates and invests money in various asset classes to meet the country’s future needs, such as retirement benefits for an aging population. They have emerged as a significant source of equity capital across the world, and are one of the top five categories of foreign investors in Indian equities. These investments are seen to be more stable than other sources of capital due to their long-term investment outlook.

Sovereign wealth funds’ stock market bets were worth Rs 1.5 trillion, according to latest depository data as of May 2018. This is lower than the previous year, and reflects half-a-trillion drop from two years ago.

Meanwhile, overall foreign portfolio investments rose by over Rs 7.4 trillion from May 2016. Sovereign wealth funds’ share of foreign investments has dropped to 5.4 per cent in May 2018 from 10.9 per cent share in May 2016.

A sovereign wealth fund is owned by the government. It accumulates and invests money in various asset classes to meet the country’s future needs, such as retirement benefits for an aging population. They have emerged as a significant source of equity capital across the world, and are one of the top five categories of foreign investors in Indian equities. These investments are seen to be more stable than other sources of capital due to their long-term investment outlook.