Home / Finance / Personal Finance / Set off and carry forward losses to save tax: All you need to know

Set off and carry forward losses to save tax: All you need to know

These measures can reduce tax incidence, but are tricky to execute

)

premium

.

Last Updated : Jun 17 2018 | 10:24 PM IST

Most of us try to use the entire Rs 150,000 limit under Section 80C to save tax. But there are other ways to reduce the tax outgo such as setting off and carrying forward losses on income and investments.

These losses may have been incurred on selling stocks, property or mutual fund units. Even interest paid on a home loan for purchasing a second home can be set off against gains on house property. “As the regulations allow carrying forward the losses, taxpayers benefit from these provisions for years to come,” says Kuldip Kumar, partner and leader – personal tax, PwC India.

The income-tax return (ITR) form has five heads of income–salary, house property, business or profession, capital gains and other sources. While a person cannot make a loss in salary, there can be losses in the other heads. “Under each head, there can be more sources of income. Under the head ‘income from capital gains’, for example, one can have income from selling a house and also from stocks. The first step is to calculate if the taxpayer has a net loss or gain in each head,” says Chetan Chandak, head of tax research, H&R Block India.

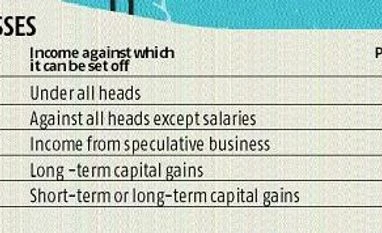

Following the sequence is essential: A taxpayer has three options to set off losses–he can set off losses against income under the same head or another head, or against the losses that are carried forward from previous years. When you adjust losses in the same head, it’s called intra-head adjustment and when set off against other heads its inter-head or inter-source adjustment.

“The taxpayer has to first knock-off losses against gains of the current assessment year and then use those carried forward from the previous years. If you have losses from earlier years, use those that are going to lapse first, followingthe first-in, first out principal,”says Naveen Wadhwa from Taxmann.com.

Home loan interest on second property: The interest that you pay on the home loan is considered as a loss from house property. For the first home, in which you reside, you can claim up to Rs 200,000 loss (or deduction) against any head of income in a financial year. Earlier, the regulations allowed taxpayers to set off the entire interest on home loan against other heads of income. But this has changed from current assessment year. Now, a taxpayer can only set off up to Rs 200,000 interest on home loan against any other income head. The remaining loss can be carried forward for up to eight years.

Say, your lender charged Rs 300,000 interest on the home loan in the financial year 2017-18. You can set off Rs 200,000 against other heads of income and carry forward the remaining amount. If you have the house on rent, you can set off Rs 100,000 against it. This provision is most beneficial to homeowners who are close to finishing off their home loans.

ALSO READ: Opt for PPF extension if you are in the highest tax bracket, here's why

ALSO READ: Opt for PPF extension if you are in the highest tax bracket, here's why

This is the only provision where a person can set off losses even if he has not filed the returns by the deadline. “For a taxpayer to set off income from any other head, they need to file their returns on time. Else, the losses lapse,” says Suresh Surana, founder, RSM Astute Consulting Group.

Capital losses can be tricky: If you incurred a loss when selling stocks, gold, property, or on redeeming mutual fund units, the setting off depends on the tenure of holding. If you sold assets within three years and had a loss, it’s classified as short-term capital loss. After three years it will be a long-term capital loss. The only exception to this is equities, where short-term capital loss may arise if you sell within one year. A short-term capital loss can be adjusted against short-term capital gains as well as long-term capital gains. If you sold stocks at a loss within one year of investment, for example, you could set it off against gains made on selling a house.

A long-term capital loss, however, can be set off only against long-term capital gains. “Equities, again, is an exception here. As there was no tax on the gains made after holding it for over a year, a taxpayer cannot set off equity losses against any head,” says Kumar.

Experts also point out that many taxpayers get confused whether they can set off losses against incomes that allow indexation benefit on the gains. Say, you have a long-term capital loss in a debt fund, which allows investors to take indexation benefit. Can it be set off against gains from bonds that don’t have the indexation provision? Tax experts say that the law does provide for such set offs.

ALSO READ: New ITR forms seek more disclosures: Know about all important changes

ALSO READ: New ITR forms seek more disclosures: Know about all important changes

Intra-day trading is speculative income: If you engaged in intraday trading, the tax laws classify it as speculative income, and the regulations to set off such losses are slightly different. “You can set off such losses only against gains made from income from speculative business. Also, you can carry forward such losses only for up to four years,” says Wadhwa.

Business or profession losses: The net loss under the head income from business or profession can be set off against any other heads of income, except for the head income from salary. In subsequent years, it can be set off only against business income for eight years. “Depreciation loss can be set off against any head of income in current as well as subsequent years, and it can be carried forward indefinitely,” says Surana.

Experts point out that if clubbing provisions apply to gains, they will also apply to the loss. “Also, no loss can be set off against income from winnings lotteries, crossword puzzles, races, card game, and any other game or gambling or betting,” says Chandak.