RBI stays vigilant, committed to early, decisive action: Governor Das

He stated that the recent implementation of macroprudential measures, aimed specifically at tempering lenders' enthusiasm in certain segments of retail loans

)

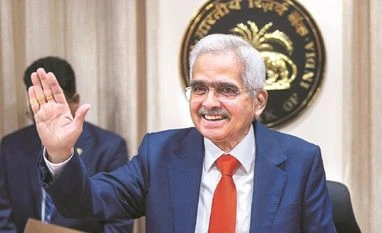

RBI Governor Shaktikanta Das (Photo: PTI)

Listen to This Article

The Reserve Bank of India (RBI) remains alert and committed to act early and decisively to prevent any buildup of risks, said Governor Shaktikanta Das in his foreword to the “Financial Stability Report” (FSR), released on Thursday.

He said the recent implementation of macro prudential measures, specifically aimed at tempering lenders’ enthusiasm in specific segments of retail loans, reaffirmed the central bank’s commitment to financial stability while ensuring the continued availability of funds for the productive needs of the economy.

After issuing warnings to banks and non-banking financial companies (NBFCs) regarding the escalating levels of unsecured loans, including personal loans and credit card debt, on November 16, the regulator raised the risk weighting for such loans from 100 per cent to 125 per cent.

Additionally, a 25 percentage-point increase was implemented for the risk weighting of bank loans extended to higher-rated NBFCs.

Das said despite facing global headwinds and emerging challenges such as technological disruptions, cyber risks, and climate change, the commitment of the central bank was unwavering. The focus remains on fortifying the financial system, encouraging responsible innovation, and fostering inclusive growth.

He highlighted the good health of the Indian financial system, marked by multi-year-high earnings, a low level of stressed assets, and robust capital and liquidity buffers within financial institutions. Substantial progress has been made since the onset of the pandemic in steering both the economy and the financial system. Now, it is crucial to consolidate these achievements, propelling the economy toward a higher growth trajectory while maintaining macroeconomic and financial stability.

More From This Section

Topics : Shaktikanta Das RBI loans

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 28 2023 | 5:22 PM IST