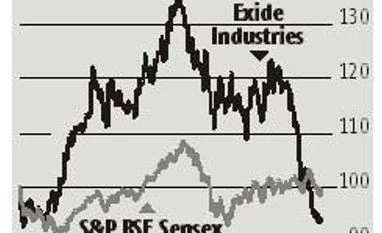

Auto slowdown, weaker-than-expected Q3 results cloud Exide's outlook

Given the slight increase in lead prices over the last month, the ability of the company to maintain margins will depend on the extent of hikes it takes

)

premium

The Exide Industries stock is down 16 per cent over the last month on weaker-than-expected December quarter results, competitive pressure, and a weak auto outlook. One of the Street’s concerns is the ability of the company to improve its operating profit margins, which came in at 12.5 per cent for the December quarter. While this was higher than the 12.4 per cent recorded in the year-ago period, it was lower than the 13.3 per cent estimated by analysts.