From Zinetac to Calpol, top 10 drugs drive India revenue for big firms

Experts expect change in strategy for a focus on high-margin products, rather than multiple brand launches

)

premium

A few thousand brand launches happen in the Rs 1.2-trillion domestic pharmaceuticals industry every year. Almost all major drugmakers market a few hundred brands in the country.

However, a deeper look shows the bulk of domestic revenue for these firms come from only the top 10 brands.

Going forward, experts feel, companies are likely to enhance their focus on the top grossing ones. In fact, the number of new brand launches has been declining — from 4,516 in 2016 to 3,932 in 2017 (source: AIOCD AWACS). In 2018, a little over 3,000 brands are estimated to have been launched, say industry sources.

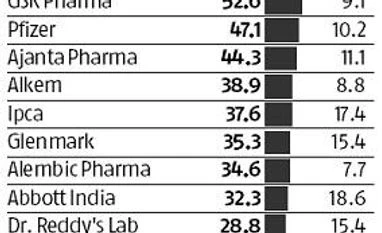

Multinational drug makers seem more dependent on their top 10 brands for revenue growth — 52.6 per cent, for example, of the revenue at GlaxoSmithKline Pharma (data as on November, of moving annual turnover).

In a recent report, Motilal Oswal showed mature brands like Augmentin (an antibiotic), Zinetac (antacid), Calpol (paracetamol), T Bact (antibiotic topical ointment) and Betnovate continued to clock double-digit growth. In November, for example, Augmentin saw 17.2 per cent year on year growth; T Bact grew 73.6 per cent. Betnovate C grew 49.6 per cent and Calpol by 13.8 per cent in that month.

In an earlier interaction with this publication, GSK Pharma’s vice-president for South Asia and managing director for India, Annaswamy Vaidheesh, had said: "We have decided to have less number of brands, to reduce complexities. This simplifies our operations and enables us to put our energy where it matters. Each brand launch takes up a lot of time and resources (from legal approvals to marketing push)."

However, a deeper look shows the bulk of domestic revenue for these firms come from only the top 10 brands.

Going forward, experts feel, companies are likely to enhance their focus on the top grossing ones. In fact, the number of new brand launches has been declining — from 4,516 in 2016 to 3,932 in 2017 (source: AIOCD AWACS). In 2018, a little over 3,000 brands are estimated to have been launched, say industry sources.

Multinational drug makers seem more dependent on their top 10 brands for revenue growth — 52.6 per cent, for example, of the revenue at GlaxoSmithKline Pharma (data as on November, of moving annual turnover).

In a recent report, Motilal Oswal showed mature brands like Augmentin (an antibiotic), Zinetac (antacid), Calpol (paracetamol), T Bact (antibiotic topical ointment) and Betnovate continued to clock double-digit growth. In November, for example, Augmentin saw 17.2 per cent year on year growth; T Bact grew 73.6 per cent. Betnovate C grew 49.6 per cent and Calpol by 13.8 per cent in that month.

In an earlier interaction with this publication, GSK Pharma’s vice-president for South Asia and managing director for India, Annaswamy Vaidheesh, had said: "We have decided to have less number of brands, to reduce complexities. This simplifies our operations and enables us to put our energy where it matters. Each brand launch takes up a lot of time and resources (from legal approvals to marketing push)."