Although this includes all delivery orders placed—online, over the phone, in-person, etc—a sizeable part of the success stemmed from the expanding online food-delivery market.

India’s food delivery sector had gone from soaring high to plunging deep into the oceans with companies shuttering and downsizing and food tech investments plunging from $500 million in 2015 to $80 million in 2016. However, restaurants and customers have been embracing online food-ordering. However, the onset of cash-flush global competition in the space could once again kick off a similar battle. There's also been a wave of consolidation lately — on-demand meal delivery startup TinyOwl was acquired by hyper-local delivery firm Roadrunnr last June. Then, in December, startup DeliveryHero acquired competitor FoodPanda.

According to RedSeer's report the restaurant industry is estimated to be $56 billion and the delivery industry is pegged at $15 billion. Online food delivery grew at a staggering pace of 150 per cent to reach $300 million in GMV terms in 2016.

Online food delivery players handled on an average 1,60,000 orders in a day with an average order value of $5. 61 per cent of the organised restaurants in Delhi, Pune, Bangalore, Hyderabad and Mumbai have delivery option.

On an average, bill value for delivery orders is 5 per cent less than that for dine in orders.

Major factors driving the growth in delivery:

•Changing consumer lifestyle

•Increasing disposable income

•Greater share of women in workforce

UberEats entry into India's foodtech space

Uber's UberEats is a new entrant in the already crowded food-tech space in India. The trend started with startups like Zomato and later Food Panda, Swiggy and TinyOwl.

While some have succeeded quite a bit, some even shut shop. In fact, rival Ola, too, tried and tested food delivery with Ola Café in April 2015 but shut operations soon enough. Now Google Areo has also come into the fray to help out companies like Faasos and Freshmenu, it remains to be seen if Uber survives in this competitive market.

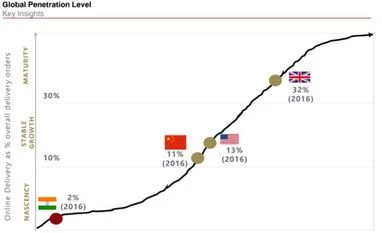

India is still a nascent market as compared to mature markets like UK where online delivery commands much higher share of delivery orders.

)