After every quarter of disappointing performance in the past, investors had hoped that the worst may be behind for bad loan-ridden public-sector banks (PSBs). But, it seems they may have to wait for another quarter, at least. Despite some expected moderation in slippages, the September 2018 quarter (Q2) is also expected to be relatively muted thanks to sustained provisioning pain and high funding costs. Thus, overall earnings, as compared to the year-ago period, are expected to remain under pressure in Q2 with many PSBs seen reporting losses. Some banks, though, could see sequential improvement.

"PSU banks are expected to report profit of Rs 3 billion (base quarter Q2'FY18 reported profit of Rs 29 billion), with Bank of Baroda (BoB) being the only bank among our universe that is expected to post profit after tax growth," said analysts at Motilal Oswal Securities in their earnings preview.

According to analysts at Emkay Global, the pace of fresh slippages is likely to have gone down sequentially in Q2, but overall credit costs (provision as a percentage of average loan book) should remain at elevated levels. Though exposure to IL&FS can add to bad loans for some banks, accelerated non-performing assets (NPAs) or bad loan recognition in the past two quarters is expected to help. Nevertheless, NPA ageing, which requires banks to set aside higher provisions as bad loans grow older, along with mark-to-market (MTM) losses on their bond portfolio, is expected to keep provisioning elevated, say analysts.

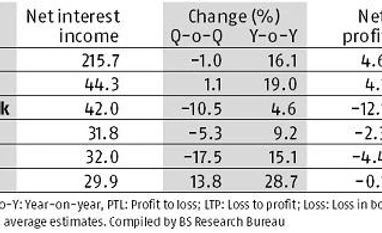

Sources: Brokerage reports, Capitaline

Firstly, unlike in the June 2018 quarter, resolution of large NPAs under National Company Law Tribunal (NCLT; list 1) was muted in Q2. While this would mean additional provisioning on existing NPAs, resolution for mid/small accounts should partly restrict the provisioning impact.

Secondly, PSBs continued to reel under bond market pressure in Q2, though the pain would be lower than in the June 2018 quarter. However, it would mean some MTM losses, thereby requiring banks to provide for the same. PSBs are major investors of government bonds (G-Sec) and according to the Reserve Bank of India's (RBI's) guidelines, the former need to provide for any erosion in market value of G-Sec (MTM losses) on a quarterly basis. The market-value of G-Sec is inversely related to bond yields, which (10-year G-Sec yields) rose by 12 basis points in Q2 to 8.02 per cent. Moreover, some banks, which had used RBI's dispensation to spread MTM losses since the December 2017 quarter equally over four quarters, could see higher pain. Not only provisioning, but high bond yields are also expected to weigh on other income due to lower treasury gains.

"Bond yields during the September quarter have also been volatile, hence treasury income is not expected to make significant contribution. Also, retail and corporate fees are likely to remain tepid, leading to weak other income on yearly basis," analysts at Sharekhan said in their Q2 preview report.

On the operational front, revenue could also feel the heat from high funding cost and slower credit growth, despite lending rate hikes undertaken by many banks.

According to RBI's data, the overall credit of the banking sector rose 12.4 per cent year-on-year as of September 2018. Much of this is estimated to be driven by the retail segment, as observed in August 2018. Since most PSBs have more exposure to corporate/wholesale account, loan book is expected to have risen below the industry level. As of August 2018, industry credit grew a meagre 1.9 per cent year-on-year. Although, the retail and small and medium enterprises (SME) segments are likely to have provided some support.

Among major PSBs, the State Bank of India (SBI), BoB and Punjab National Bank (PNB) are expected to report five-seven per cent year-on-year increase in advances in Q2. The loss for PNB is expected to decline sequentially, while SBI is seen returning to profits in Q2 (after three consecutive losses). BoB, however, is expected to see strong profit increase, say analysts.

)