Rising rupee another risk for Indian pharma

Companies would also have levers like cost cutting to mitigate some of the pressure

)

premium

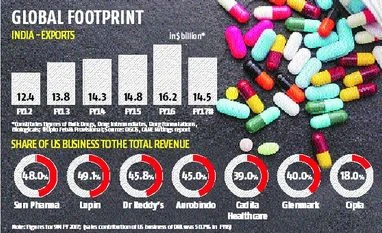

Note: Figures for 9M FY 2017; (sales contribution of US business of DRL was 50.7% in FY16)

Pricing pressure and regulatory issues are not the only thing worrying executives of Indian pharmaceuticals companies.

Weakening of the dollar versus the rupee in the first four months of this calendar year is adding to the concerns; it might impact their earnings by five or six per cent. An appreciation in the rupee versus the dollar means every one of the latter yields less of the former, whereas a lot of the costs are denominated in rupees. Dr Reddy’s Laboratories (DRL), Lupin and Sun Pharmaceutical earn close to half their revenue from the US market. DRL has the highest foreign exposure among large-cap stocks and earns 85 per cent of its revenue from abroad (53 per cent from North America); the rest is from India. Cipla, which earns 40 per cent of revenue from within India, would see the least impact from rupee appreciation; its US sales account for 18 per cent of the revenue.

On a year-to-date basis (from January till this Thursday), the rupee has gained 5.45 per cent against the dollar. On a year-on-year basis, the rupee is up 3.47 per cent.

“If the current spot rates persist through the year, based on the companies’ overseas business exposure, we estimate 1.8-6 per cent decline in FY18 profit,” said Anmol Ganjoo of JM Financial Institutional Securities. The brokerage had factored an average rate of Rs 67 to a dollar in the year. The current value is 64.41. With US President Donald Trump trying to talk down the dollar, it could depreciate further against global currencies, including the rupee. Edelweiss Securities is likely to cut its earning estimate for FY18 by one to five per cent. “A depreciating dollar is one more challenge for pharma companies and adding to their woes,” said Deepak Malik of Edelweiss Securities. Other brokerages estimate a one to three per cent reduction in pharma companies’ earnings with every one per cent appreciation in the value of the rupee versus the dollar.

While companies have manufacturing facilities in the US, they ship most of the products from India. In rupee terms, sales from the US turn lower (on account of dollar depreciation), though there are attached costs, impacting profitability. Companies, however, do hedge some of their currency exposures, while currency movement in other regions also have an influence on the numbers. And, this might vary across companies.

DRL say its growth is not contingent on currency considerations. “In FY17, we have not witnessed any major impact on account of currency. On the positive side, the rouble’s (Russian currency) appreciation has helped. We have a well-structured hedging policy, with our balance sheet being fully hedged. About half of our net dollar cash flow exposure and about a third of the net rouble cash flow exposure is hedged,” said a DRL spokesperson.

Adding: “We are well-positioned for sustained profitable growth, given our strong base business and proven capability in complex generics, with strategic investments in R&D for our proprietary products and biologics businesses.”

Weakening of the dollar versus the rupee in the first four months of this calendar year is adding to the concerns; it might impact their earnings by five or six per cent. An appreciation in the rupee versus the dollar means every one of the latter yields less of the former, whereas a lot of the costs are denominated in rupees. Dr Reddy’s Laboratories (DRL), Lupin and Sun Pharmaceutical earn close to half their revenue from the US market. DRL has the highest foreign exposure among large-cap stocks and earns 85 per cent of its revenue from abroad (53 per cent from North America); the rest is from India. Cipla, which earns 40 per cent of revenue from within India, would see the least impact from rupee appreciation; its US sales account for 18 per cent of the revenue.

On a year-to-date basis (from January till this Thursday), the rupee has gained 5.45 per cent against the dollar. On a year-on-year basis, the rupee is up 3.47 per cent.

“If the current spot rates persist through the year, based on the companies’ overseas business exposure, we estimate 1.8-6 per cent decline in FY18 profit,” said Anmol Ganjoo of JM Financial Institutional Securities. The brokerage had factored an average rate of Rs 67 to a dollar in the year. The current value is 64.41. With US President Donald Trump trying to talk down the dollar, it could depreciate further against global currencies, including the rupee. Edelweiss Securities is likely to cut its earning estimate for FY18 by one to five per cent. “A depreciating dollar is one more challenge for pharma companies and adding to their woes,” said Deepak Malik of Edelweiss Securities. Other brokerages estimate a one to three per cent reduction in pharma companies’ earnings with every one per cent appreciation in the value of the rupee versus the dollar.

While companies have manufacturing facilities in the US, they ship most of the products from India. In rupee terms, sales from the US turn lower (on account of dollar depreciation), though there are attached costs, impacting profitability. Companies, however, do hedge some of their currency exposures, while currency movement in other regions also have an influence on the numbers. And, this might vary across companies.

DRL say its growth is not contingent on currency considerations. “In FY17, we have not witnessed any major impact on account of currency. On the positive side, the rouble’s (Russian currency) appreciation has helped. We have a well-structured hedging policy, with our balance sheet being fully hedged. About half of our net dollar cash flow exposure and about a third of the net rouble cash flow exposure is hedged,” said a DRL spokesperson.

Adding: “We are well-positioned for sustained profitable growth, given our strong base business and proven capability in complex generics, with strategic investments in R&D for our proprietary products and biologics businesses.”

Note: Figures for 9M FY 2017; (sales contribution of US business of DRL was 50.7% in FY16)