Sales growth consistency help fast food majors launch more stores

Firms strategising for future as low base effect is expected to taper shortly

)

premium

Last Updated : Aug 09 2018 | 1:02 AM IST

The last three quarters have seen fast food majors having a field day, reporting double-digit sales growth consistently.

Noida-based Jubilant FoodWorks — the master franchisee of Domino’s and Dunkin’ Donuts in India —saw same-store sales growth (SSG), a crucial metric tracked by analysts of stores, which are at least one year old, at 17.8 per cent for the December quarter, jumping to 26.5 per cent for the March quarter and 25.9 per cent for the June quarter.

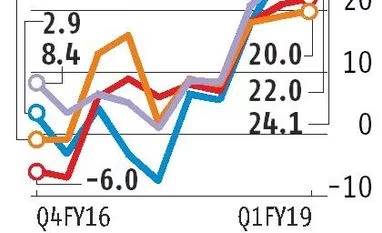

Westlife Development, which runs McDonald's stores in the south and west of India, on the other hand, saw SSG at 20.7 per cent for the December quarter, touching 25.1 per cent for the March quarter and 24.1 per cent for the June quarter.

Yum! Brands, which owns and operates Pizza Hut and KFC joints, reported a system sales growth of 22 per cent and 20 per cent, respectively, for the June quarter in India — the highest in two years.

This was fuelled by an 18 per cent system sales growth, respectively, for Pizza Hut and KFC in the December quarter. Figures jumped in the March quarter to 21 per cent (Pizza Hut) and 19 per cent (KFC).

System sales growth, in industry parlance, implies topline growth. Yum! does not disclose country-wise SSG numbers for its restaurants.

Experts are of the opinion that while there is no denying a recovery in consumer sentiment, prompting many to make a beeline for quick-service restaurants (QSRs), at the heart of it all is a favourable base. “The reason for the high numbers on the SSG front is due to a low base in the year-ago period," says Sachin Bobade, senior research analyst at Mumbai-based brokerage Dolat Capital. “This advantage will fade after the September quarter,” he adds.

A look at the year-ago September quarter SSG numbers for two listed players — Jubilant FoodWorks and Westlife Development — gives a clear indicationof this.

Last year, both of them saw SSG come in at 5.5 per cent and 8.4 per cent, respectively, for the July-September period. This was, in fact, the last quarter before the two players began seeing double-digit SSG growth. So a high base effect in other words, say experts, will begin kicking in from the December quarter this year.

How are companies gearing up for this then? According to analysts, Jubilant FoodWorks and Westlife Development are expected to keep their momentum going in terms of new store additions, ensuring that growth levels do not slip in the second half of the year. The management of Jubilant FoodWorks last month said it would ramp up store additions to 75 for the current financial year, up from 24 new stores the company added in the last financial year.

Westlife Development has indicated that it will take its McDonald’s store network to 450-500 by 2022 from 281 now.