The discount warriors: How online pharmacies are disrupting the trade

The offline chemists are trying to fight back by extending 10 per cent discounts to customers, which only bigger chemists near hospitals used to offer

)

premium

Last Updated : Sep 24 2018 | 7:31 AM IST

Soumen Mitra has been a diabetic for 20 years. Unless his sugar fluctuates, his medicines remain the same. By the 25th of every month, he places an order with an e-pharmacy which couriers him the medicines in a few days at a 20-25 per cent discount to the price his neighbourhood chemist charges.

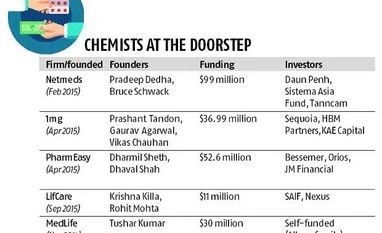

E-pharmacies like Netmeds, 1mg, PharmEasy and Medlife are riding on customers like Mitra and discounts to have a pie of India's Rs 1 trillion pharmacy market. With cumulative sales of Rs 1.5 billion (estimated), they are scratching the surface. But investors are hoping that digitisation will drive customers to buy medicines online, especially for chronic diseases.

Investors are impressed with the way 1mg, PharmEasy, Netmeds, and Medlife have scaled in a short span — an insider estimates each of the top three players to be grossing Rs 300 million a month. "We expect at least 2-3 of these companies to exceed billion dollars in gross merchandise value delivered annually," says Badri Pillapakkam, investment partner, Omidyar Network.

With the government, this month, unveiling draft rules for e-pharmacies — which requires them to register, sell medicines on prescriptions, store customer data within the country — things can only get better. E-commerce majors such as Amazon and Flipkart will enter this space or buy out existing players, say experts.

The offline chemists are trying to fight back by extending 10 per cent discounts to customers, which only bigger chemists near hospitals used to offer. A few have co-opted and become franchisees for e-pharmacies and service their orders with 15-18 per cent discounts and offset those with higher volumes. Overall, chemists have seen their margins sink from an average 20-25 per cent to 10-15 per cent today.

Concept

E-pharmacies deliver over-the-counter medicines, which do not require a prescription from the doctor, as well as those which require prescriptions. A patient can also sign up for refilling medicines every month.

In India, medicines are often sold without prescriptions. People also often ask chemists which medicine to buy for common ailments. With online pharmacies, the sale of spurious drugs has come down, says Doctor Insta founder Amit Munjal. A regulated e-pharmacy market can be a safer way of delivering the prescribed dosage of drugs.

Except for NetMeds, which has warehouses, others are marketplaces, where franchisees supply medicines while the delivery is taken care of by e-pharmacies.

Chemists, typically, can store 3,000-5,000 items but there are over 200,000 stock keeping units in the pharmacy business. Franchisees can access warehouses which can stock more. E-pharmacies also help chemists/franchisees to stock, telling them which medicines to keep and in what quantity.

Opportunity

The Indian pharmacy market is worth Rs 1 trillion, equally split between chronic and non-chronic segments, which includes medicines required in an emergency. E-pharmacies have penetrated less than 1 per cent of the market. The chronic care market is estimated at Rs 500 billion. For starters, e-pharmacies could target Rs 50 billion of this market.

With increasing smartphone usage, the penetration of e-pharmacies is likely to increase — in the US, online sales of medicines account for 10-15 per cent of the market — though offline chemists in India would continue to have the lion’s share.

“The chemist will remain important in India as often only they are able to understand what the doctor has prescribed. They know the patients and know which medicines will suit them,” says Rahul Darda, founder, Brinton Pharmaceuticals. Interestingly, China does not allow online sale of medicines.

Chemist associations often discourage retailers from offering discounts, threatening to cut supplies if they do. “We have to give it in writing that we won’t,” says a chemist in Mumbai. Three years back, he was struggling but now earns Rs 1 lakh a month after he became a franchisee for an e-pharmacy.

Revenue model

The pharma business works on a 30 per cent trade margin — the wholesaler earns 10 per cent and the retailer 20 per cent; for price-controlled drugs, the margins are 8 and 16 per cent, respectively, but they constitute just 20 per cent of the market. On generic drugs, margins can be as high as 250 per cent for chemists.

E-pharmacies are working with large chemists and pushing them to pass on 18-20 per cent to customers as discounts. Payment firms like Paytm or Mobikwik extend an additional 5 per cent discount as cashback or recharge to acquire customers.

The e-pharmacies earn 2 per cent on every order (from retailers) and 5 per cent if they are doing deliveries. If an e-pharmacy also carries stocks it can pocket the wholesale margin but it has its costs.

E-pharmacies have both wholesale and retail licences. Due to higher volumes, the wholesale company is able to buy medicines say at 35 per cent lower cost than the retail price. This includes the 30 per cent trade margin. Now, keeping 5 per cent, it passes on the medicines to retailers/franchisees. They, in turn, pass on 18-20 per cent to customers. In all, e-pharmacies are earning 7 per cent margin to cover all costs.

As margins are low, none of the e-pharmacies makes money. As volumes go up, they expect costs to come down. They make some money through ads and hope to develop other revenue streams by tying up with other service providers. Margins have shrunk but the sale of generics, which constitute 30-35 per cent of the market, continues to provide a cushion to the pharma trade, including e-pharmacies.

With the government recognising and regulating e-pharmacies, business is likely to get better.