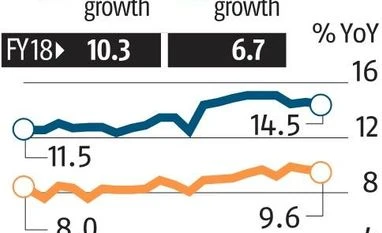

Bank credit up 14.5% to Rs 94.29 trn, deposits rise 9.63%: RBI data

The pick-up in economic activity has boosted credit demand

)

premium

The pace of growth in bank credit, as well as deposits, has moderated on a fortnightly basis. While credit grew 14.5 per cent to Rs 94.29 trillion, deposits rose a tepid 9.63 per cent to Rs 121.22 trillion for the fortnight ending February 1, according to the latest Reserve Bank of India (RBI) data. In the fortnight ended January 18, deposits had increased by 9.69 per cent to Rs 119.86 trillion and credit grew 14.61 per cent to Rs 93.32 trillion, the RBI data showed.