Highlights: RBI reduces repo rate by 75 bps to 4.4%; slashes CRR by 100 bps

The Monetary Policy Committee (MPC) has decided to reduce the reverse repo rate by 90 basis points (bps) to 4 per cent, and cash reserve ratio by 100 bps to 3 per cent

)

premium

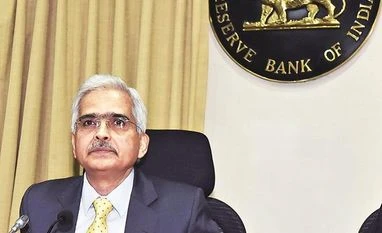

RBI Governor Shaktikanta Das

A day after Finance Minister Nirmala Sitharaman released a Rs 1.7 trillion package to curb the impact of the 21-day coronavirus lockdown, the Reserve Bank of India (RBI) on Friday cut benchmark interest rate by 75 basis points to 4.4 per cent to deal with the hardship caused due to the outbreak of Covid-19.

The central bank also reduced the cash reserve ratio (CRR) of all banks by 100 basis points to 3 per cent with effect from March 28 for 1 year. RBI will maintain accommodative stance, Governor Shaktikanta Das said while announcing decisions of Monetary Policy Committee (MPC).