Fuel paradox: 6 more pvt players on cards, but price reins still with govt

Setting of retail prices, frequency with which they change and government increasing taxes when global prices are low all put a question mark on so-called market-linked pricing mechanism

)

premium

The OMCs did not change retail prices for the period covering the monsoon session of Parliament because of the strong criticism against the government for high diesel and LPG prices.

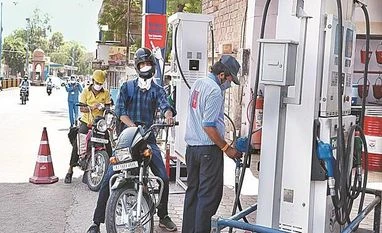

The Indian automotive fuel market is hotting up with the Union government granting permission to seven entities to retail liquid and alternative fuel. Among those is Reliance Industries Ltd (RIL) that needed the government re-approval because of a business restructuring. With this, there will be some 14 players in the domestic petroleum industry’s marketing business. Despite this, the government’s role in the pricing of fuel continues to be unclear.

Officially, the Union government maintains an arm’s-length relationship in the retail pricing of petrol, diesel and even compressed natural gas (CNG). Yet, it continues to have a say in what consumers pay, both in the form of taxation tweaks as well as through informal directives to state-owned oil marketing companies (OMCs).

The OMCs, for instance, did not change retail prices for the period covering the monsoon session of Parliament because of the strong criticism against the government for high diesel and LPG prices. Nor has the government reduced levies that constitute 32 per cent of petrol and 35 per cent of diesel prices in Delhi even though fuel prices are at record highs.

Union Finance Minister Nirmala Sitharaman has now cited fiscal constraints for not reducing fuel taxes even though global benchmark prices have risen, hurting the consumer pocket. She cited as a reason the repayment burden on oil bonds issued under the predecessor United Progressive Alliance (UPA) to OMCs.

Oil bonds worth Rs 1.34 trillion were issued during 2005-2010 to subsidise retail prices without any cash outgo from the government. The annual outgo on account of these bonds, however, is around Rs 10,000 crore whereas the Centre collects over Rs 2.8 trillion as its share of tax on petroleum products.

There is, meanwhile, no official reason for prices not changing, though OMCs shifted to daily price change for petrol and diesel in 2017. It is believed that the companies were holding prices for political exigencies of a Parliament session and preparation for state Assembly elections.

Officially, the Union government maintains an arm’s-length relationship in the retail pricing of petrol, diesel and even compressed natural gas (CNG). Yet, it continues to have a say in what consumers pay, both in the form of taxation tweaks as well as through informal directives to state-owned oil marketing companies (OMCs).

The OMCs, for instance, did not change retail prices for the period covering the monsoon session of Parliament because of the strong criticism against the government for high diesel and LPG prices. Nor has the government reduced levies that constitute 32 per cent of petrol and 35 per cent of diesel prices in Delhi even though fuel prices are at record highs.

Union Finance Minister Nirmala Sitharaman has now cited fiscal constraints for not reducing fuel taxes even though global benchmark prices have risen, hurting the consumer pocket. She cited as a reason the repayment burden on oil bonds issued under the predecessor United Progressive Alliance (UPA) to OMCs.

Oil bonds worth Rs 1.34 trillion were issued during 2005-2010 to subsidise retail prices without any cash outgo from the government. The annual outgo on account of these bonds, however, is around Rs 10,000 crore whereas the Centre collects over Rs 2.8 trillion as its share of tax on petroleum products.

There is, meanwhile, no official reason for prices not changing, though OMCs shifted to daily price change for petrol and diesel in 2017. It is believed that the companies were holding prices for political exigencies of a Parliament session and preparation for state Assembly elections.

Topics : Fuel prices OMCs fuel retail petrol diesel CNG