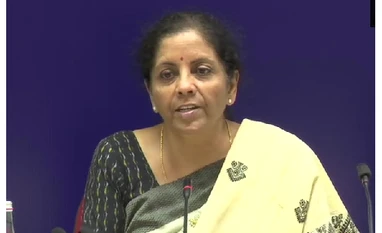

Addressing a press conference following the GST Council meet, Finance Minister Nirmala Sitharaman also brought the manufacture of matches to a common rate of 12 per cent across the board. Earlier, hand-made matches attracted 5 per cent, while machine-made ones attracted 18 per cent.

She also said interest for delayed GST payment will be charged on net tax liability, not gross tax liability, and would be effective July.

Sitharaman said all decisions taken at today's GST Council meeting would come into effect on April 1.

Stating that a there were a host of technical glitches in GST administration, the minister said she was engaging with Infosys to implement reforms and had asked the firm to come up with a sustainable solution. She added that Nandan Nilekani had made a presentation to this effect today and that she had asked Infosys to be present for the next three GST council meetings.

Sitharaman also demanded better coordination between Tech Mahindra & Infosys without the Ministry's intervention. She said that tasks that were earlier to be completed by January 2021 will now be accomplished by Jun 2020.

GST on MRO services with respect of aircraft has been brought down from 18 per cent to 5 per cent, with full input tax credit (ITC)

The due date for filing the annual return for FY 2018-19 has been extended to June 30. Sitharaman said late fees would not be levied for delayed filing and reconciliation statement for 2 years, for taxpayers with turnover less than Rs 2 crore.

)