Non-priority sector loans worsen NPA headache for public sector banks

These bad debts constitute 23% of advances of 10 PSBs at the end of FY18

)

premium

Last Updated : Jun 29 2018 | 6:45 AM IST

The headline number for non-performing assets (NPA) of public sector banks (PSB) masks the sharp deterioration of their industry loan books over the past year.

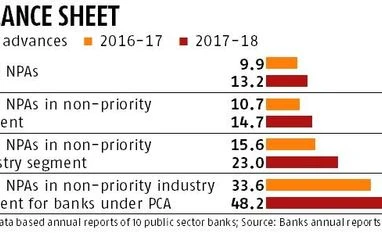

A Business Standard analysis of the balance sheets of 10 PSBs shows that a staggering 23 per cent of loans to industry in the non-priority segment turned bad at the end of FY18, up from 15.6 per cent at the end of FY17. In the case of some banks, over 50 per cent of loans to industry turned bad.

These numbers suggest the headline numbers of bad debts have been dragged down by lower defaults in the priority loan book and in the services and personal loans segment.

The analysis is based on Gross NPA (GNPA) data of 10 PSBs—State bank of India, Bank of Baroda, Andhra Bank, Union Bank of India, Central Bank of India, Syndicate Bank, Allahabad Bank, Oriental Bank of Commerce, Indian Bank and Indian Overseas Bank. At the aggregate level, GNPAs of these 10 PSBs (including priority and non-priority) rose to 13.2 per cent at the end of FY18, up from 9.9 per cent in FY17.

Much of this rise is due to higher defaults among non-priority loans. At the aggregate level, GNPAs in the non-priority segment rose to 14.7 per cent at the end of FY18, up from 10.7 per cent in the previous fiscal. This deterioration in the non-priority segment loan book has been driven largely by rising defaults in the industry loan book. GNPAs in the non-priority industry segment have surged to 23 per cent in FY18, up from 15.6 per cent in FY17. These numbers are in line with the data in the RBI’s recent financial stability report.

“The GNPA ratio in the industry sector rose from 19.4 per cent to 22.8 per cent during the same period whereas stressed advances ratio increased from 23.9 per cent to 24.8 per cent,” it noted.

The headline GNPAs of scheduled commercial banks are likely to rise to 12.2 per cent by the end of March 2019, up from 11.6 per cent at the end of March 2018, it added.

Excluding SBI, the picture is worse, with 30.7 per cent of advances to industry of the remaining banks turning bad at the end of FY18, up from 22.8 per cent in FY17.

In the case of IOB, GNPAs stood at a whopping 58.8 per cent in FY18 in the non-priority industry segment, up from 39.5 per cent in the previous fiscal. For Oriental, bad loans rose to 50.2 per cent, up from 42 per cent in the previous year. On the other hand, bad loans for SBI and Indian Bank were relatively lower at 17.96 per cent and 12.6 per cent, respectively.

According to the financial stability report, “Within industry, the stressed advances ratio of sub-sectors such as ‘gems and jewellery’, ‘infrastructure’, ‘paper and paper products’, ‘cement and cement products’ and ‘engineering’ registered an increase in March 2018 from levels in September 2017.”

The situation of PSBs placed under the RBI’s prompt corrective action (PCA) is even worse. Data shows that for these banks, roughly 48 per cent of non-priority loans turned bad at the end of FY18, up from 33.6 per cent in the previous year. However, experts believe the bad loan problem is finally turning a corner.

“Loans in the special mention accounts 2 category are now below 1 per cent. This suggests that the stress in the system is largely recognised. Thus, the incremental addition to NPAs is expected to slow down,” says Anil Gupta, vice-president and sector head (financial sector ratings) at ICRA.

“We expect GNPAs to decline below 9 per cent by March 2019, due to recoveries from the ongoing insolvency process and write-offs by banks,” he added.

“I think legacy issues have been addressed, as most of the recognition of bad loans is over,” said Madan Sabnavis, Chief Economist at CARE.

But he added that challenges remain. “One, the issue of capital adequacy needs to be addressed. Second, as 11 banks have been placed under the RBI’s PCA framework, credit growth is likely to remain sluggish,” said Sabnavis.