59-minute loans: Leapfrogging MSME lending through technology

The criticality of credit flow to the MSMEs is borne out of its contribution to employment and inclusive growth

)

premium

A survey found that job losses in the MSME sector has been about 32 per cent

Last Updated : Dec 07 2018 | 2:53 PM IST

Though the term financial inclusion is of recent origin, as an idea it has been at the fulcrum of India’s development policy. Milestones like nationalisation of banks, priority-sector lending, promotion of microfinance, interest subvention for agriculture in the past and establishment of MUDRA and the successful implementation of PMJDY in last four years amply demonstrate the policy intent.

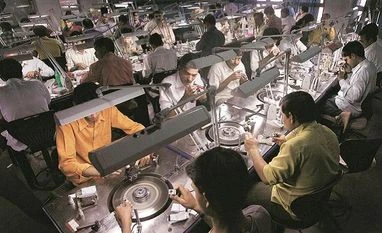

Within this broad ambit of inclusion, acceleration of credit flow to Micro and Small Enterprises (MSME) has occupied policy centre stage in last few years. The criticality of credit flow to the MSMEs is borne out of its contribution to employment and inclusive growth. As per the 2017-18 annual report of the Ministry of MSME, there are 63.39 million MSMEs in India providing 110 million jobs and contribute 30% to the national GDP. The fact that the MSME space is overwhelmingly dominated by micro and small enterprise provides it with the ability to foster broad based inclusive growth by creating enterprises and jobs at the local level (51% of MSMEs in India are in rural areas) and thereby be an antidote to the problem of jobless growth in the corporate sector.

Though lending to Small Scale Industries (SSI) was included in the list of priority sector in 1960s, MSMEs in India continue to face severe credit constraint. The share of credit to MSMEs in banking sector’s non-food credit has been steadily declining (currently at 14.5%) and the problem is accentuated by the fact that the share of “micro and small” within the larger set of industry credit is paltry at 15%.

While there are no reliable estimates of the credit gap, one often comes across statements from various quarters that nearly 90% of Indian MSMEs are dependent on self-funding. This situation has led to micro and small enterprises being referred to as the “lost middle” between small sized microfinance loans and larger sized loans from banks. The gap between credit requirement of MSMEs and the actual credit flow stems from the perceived risks in MSME lending, larger presence of informal enterprises, information asymmetry and the consequent difficulties for banks in appraising and underwriting loans to MSMEs.

In recent past, the Government, RBI and SIDBI have taken critical steps to address the issue. A slew of measures can be seen such as setting up of MUDRA and the launch of Pradhan Mantri Mudra Yojana (PMMY), Stand-up India scheme in 2015 to promote entrepreneurship at grass root level for economic development and job creation, RBI earmarking a sub-limit of 7.5% under priority sector exclusively for “micro” enterprises, launch of a new portal (www.udyamimitra.in) by SIDBI to act as a match making platform for MSME loans up to Rs2 crore and enhancement in coverage amount under credit guarantee scheme. Though these are initiatives with positive intent, the weakness of this approach is that while these measures exhort the banks to lend, they do not tackle the practical day to day problems faced by bankers in lending to micro and small enterprises. The credit requirements of micro and small enterprises are varied, information is not easily available and the loan appraisal consumes a significant time of bankers at branch level, which is not proportional to the interest income.

The recent launch of the portal (psbloansin59minutes.com) can be a game changer in easing the problems of bankers in MSME lending. Conceived as a fintech platform with majority ownership of SIDBI and five other public sector banks, it has integrated nearly 120 MSME loan products of 21 public sector banks taking into account the distinct appraisal metrices of banks. MSMEs having loan requirement of up to Rs 1 crore can use this site to get an in-principle approval from a chosen bank. The MSME has to register and then fill the online form requiring details like GST returns, income tax returns, bank account details, business details and the loan requirement. Based on these information, the portal does the appraisal in real time using sophisticated algorithm and throws up the names of banks and details of loan products which match the demand. In case, due to information deficiency, no match is found, the user is guided about the lacunae. The user has the flexibility to choose from matched banks offers and get an in-principle approval from the portal on payment of Rs1,000 fee. Any user who just wants to check eligibility or seeks renewal of existing credit facility does not pay anything. On the banker’s side, the portal gives the machine analysed information of the potential borrower on key parameters like financial ratios, financial statements, credit bureau report and loan eligibility calculation among others – all within 59 minutes, which normally takes weeks to collect and analyse. Besides easing the work of entrepreneurs and banks, its significance for the regulator and public policy lies in efficient monitoring as number of in-principle approvals converted into sanctions and disbursement across banks and regions is now available on a click. The database which will be built through this portal has the potential to provide useful insights for MSME policy making.

There is however also a flip side to it. Informal enterprises who not having GST or Tax footprint cannot be part of this digital journey, which is a dampener as majority of micro enterprises get excluded. Implementation of GST is a step towards formalisation of the economy but it will take time to show results at micro and small enterprises level. Further, private sector banks and NBFCs which have emerged as major players in MSME lending are currently not part of this portal. Public sector banks account for only 50% of lending to MSMEs. Finally, the credibility of the portal and the process will only be established if higher percentage of in-principle approvals convert into actual credit flow. At present, nearly 20,000 entrepreneurs have used this site to get in-principal approval. While interactions with bankers and MSMEs drives home the point that the ecosystem and rails for MSME lending has been built through this initiative, its success in untying the knots in MSME lending will largely depend on bankers intent, Government confining its role to being a facilitator sans imposing any target based approach and higher level of formalisation of MSMEs.

The author is professor and chairperson at School of Public Policy & Governance.

Disclaimer: Views expressed are personal. They do not reflect the view/s of Business Standard.