Going digital: Banking apps still preferred choice over mobile wallets

This applies more to large value transactions, say experts

)

premium

Last Updated : Aug 11 2018 | 5:08 AM IST

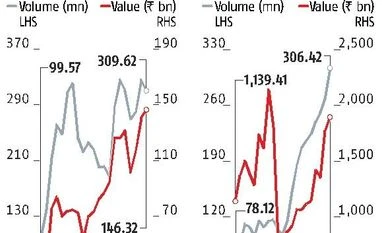

Mobile banking has seen a constant monthly rise in both volume and value since almost a year, whereas for newer entrants like wallets, it has been a bumpy road.

Even United Payments Interface (UPI), which has shown exponential growth since introduction, saw a fall in monthly volume in July.

Most importantly, the value of mobile banking is in multiples of the value of wallet and UPI transactions.

This is mainly due to the customer being more comfortable with banking applications for making high-value transactions, feel experts.

“According to our research, there is a distinction between wallets and banking apps in the mind of customers. Wallets are mostly used for small value payments and customers expect wallet ecosystems to have opportunities for shopping, offers and cash back.

“On the other hand, banking apps are expected to provide the entire array of banking products and services - savings, payments, loans and investments,” said Mahesh Makhija, Partner, Financial Services Advisory Services, EY India.

He added that banks push greater mobile transactions since it is a low cost channel for them.

YES Bank said it is focused on a Mobile-first strategy. The bank has started to ship a new mobile app version every month, catering to features based on customer feedback.

“These strategies have helped us maintain customer satisfaction, visible in the 4.5x rise of our mobile banking customer base, since the launch of YES Mobile 2.0. Monthly transaction volumes have gone up by six times and we are expecting value of transactions to cross Rs 300 billion this financial year,” said Ritesh Pai, Chief Digital Officer, YES Bank.

Monthly mobile banking transactions have almost doubled over the past year, whereas wallet transactions grew 31 per cent, shows data released by the Reserve bank of India (RBI).

The wallet industry was struggling with stringent know-your-customers norms resulting in a drop in transactions earlier in the year. However, the recent months show positive growth of wallets on the back of promotions and incentives.

“This is largely led by e-commerce and in particular, the travel and entertainment industries. There are more uses for wallets now, apart from small purchases and P2P transfers where people use their wallet balance to book flight and movie tickets as well as public transport tickets as well,” said Deepak Chandnani, managing director, Worldline (South Asia and West Asia).

However, both Makhija and Chandnani, said whether the wallet growth would be sustainable after removing cashbacks from the equation is still to be seen.

While wallets will serve a limited purpose, UPI will continue to expand in both value and volume, said experts.

“We expect UPI usage to increase dramatically due to its convenience and the incentives given,” said Makhija.

Currently, only 10 per cent of UPI transactions are merchant to peer with the rest being peer to peer payments.

However, the introduction of UPI 2.0 would change that and drive up the value of transactions immensely, said experts.

“The average ticket size (ATS) has gone up from Rs 1,025 in January to Rs 1,945 in July. This shows that people trust the UPI system and are willing to make transactions of larger amounts through it,” said Chandnani.