Green shoots of liquidity for NBFCs, HFCs in commercial paper market

Rating agency CRISIL in a statement said there had been some change in market sentiment over the past two weeks with gradual easing in funding access for non-banks

)

premium

Last Updated : Nov 09 2018 | 5:30 AM IST

The worst may be over for non-banking finance companies (NBFCs) and housing finance companies (HFCs) as far as raising funds from the commercial paper (CP) market is concerned.

After the liquidity squeeze following the default by the IL&FS group in September, there are early signs of a recovery in the CP market with non-bank lenders (NBFCs and HFCs) raising Rs 300 billion in October.

Almost half of this, or Rs 150 billion, was raised in the last week of October, albeit at a higher cost, according to market sources.

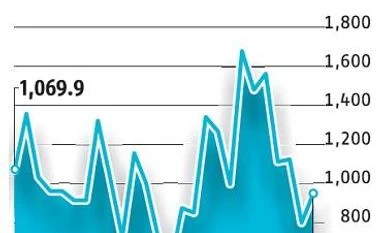

The Reserve Bank of India (RBI) data on CP issuance by corporates and finance companies also points to the shift in sentiment. After the amount of reported CP issuances declined sharply in September (see adjoining chart) and plunged further to an almost six-month low in the first fortnight of October, there has been some recovery. The CP issuances rose by 19 per cent to Rs 949 billion in the fortnight ended October 31, up from Rs 799 billion in the previous fortnight.

Rating agency CRISIL in a statement said there had been some change in market sentiment over the past two weeks with gradual easing in funding access for non-banks.

Krishnan Sitaraman, senior director, CRISIL Ratings, said CP volumes had increased in the last week of October and if the trend continued, rollover rates should be higher in November.

Seconding that view, Lakshmi Iyer, chief investment officer (debt), Kotak Mutual Fund, said, “Right now, CPs up to three-month maturities are having demand. However, the sentiment has improved. The issuances in the CP market could possibly cross Rs 1 trillion in November.”

Experts say the larger non-bank entities are covered to meet their near-term repayment cycle, and hence the much-talked-about crisis may be averted.

The 50 large CRISIL-rated non-banks have debt repayments worth Rs 950 billion due in November. Of this, Rs 700 billion is related to CPs maturing. While some non-banks are well-placed to meet debt repayments without using the bank lines, others may have to do so, at least partially, CRISIL said.

“Liquidity for NBFCs is comfortable. While they are covered for their current repayment cycle, any fresh funding remains a challenge. So their business expansion rate may slow,” said Mahendra Jajoo, head (fixed income), Mirae AMC.

Besides difficulties in getting funding for fresh business, experts are keeping an eye out for the amount of the rollover, which is low as of now. “For top-tier companies (as perceived by the market) the extent of rollovers is around 50 per cent. However, for tier II companies, the rollover is under 10 per cent,” Jajoo added.

Recent steps by regulators such as the RBI and the National Housing Bank, and large banks such as State Bank of India, to improve access to funds, have also benefited non-banks.

SBI has provided liquidity to NBFCs and HFCs by purchasing their loans worth Rs 52.50 billion in October and deals worth Rs 159.4 billion are in the pipeline. SBI has set a target of Rs 450 billion for buying assets from non-bank lenders by the end of March 2019, said the bank's chairman, Rajnish Kumar.

DBS Bank in a research note on Thursday said amid support from public sector banks, the liquidity squeeze faced by India’s NBFCs had eased a bit in recent days. But balance-sheet constraints and higher funding costs will likely prompt NBFCs to slow their lending activity.

In this milieu where raising money becomes a challenge, securitisation has emerged as a significant alternative for liquidity, especially for HFCs. Another funding avenue gaining traction is retail bonds.

Non-banks have raised around Rs 270 billion through retail bonds in FY19 (up to September), compared to Rs 50 billion raised in 2017-18, CRISIL said.