PMC Bank scam: EOW arrests HDIL's Rakesh Wadhawan, Sarang Wadhawan

ED registers money laundering case in PMC Bank loan fraud

)

premium

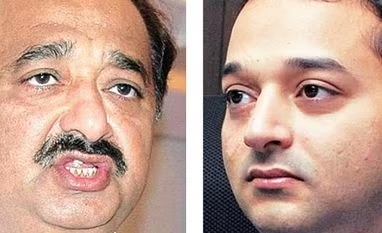

Rakesh Kumar Wadhawan and Sarang Wadhawan

3 min read Last Updated : Oct 07 2019 | 5:14 PM IST

The economic offences wing (EOW) of the Mumbai police arrested Housing Development & Infrastructure (HDIL) promoter Rakesh Wadhawan and his son Sarang Wadhawan on Thursday in connection with the Punjab and Maharashtra Co-operative (PMC) Bank scam.

The EOW also seized assets worth Rs 3,500 crore of HDIL.

Sources said former PMC Bank managing director Joy Thomas’ accounts had been seized, and the police also searched the residence of S Waryam Singh, the bank’s former chairman, and confiscated one of his demat accounts having investments of Rs 100 crore.

In a press conference, an EOW official said the police were searching for Thomas and others named in the First Information Report (FIR) on irregularities at PMC Bank.

The FIR was registered by the police on September 30.

Meanwhile, the Enforcement Directorate (ED) registered a criminal case of money laundering against Waryam Singh, Joy Thomas, HDIL’s Wadhawans, and the other officials and entities named in the FIR.

Confirming the development, an ED official said an Enforcement Case Information Report (ECIR) had been filed on Thursday under the Prevention of Money Laundering Act (PMLA) to probe the alleged fund diversion at PMC Bank. An ECIR is the ED’s equivalent of a police FIR.

“Prima facie, it appears that certain amounts of kickbacks generated in the loan deal were laundered to create tainted assets,” the ED source said, adding that the proceeds of crime appear to be much more than the loan amount which is under probe by the police. “We examined the report filed by the police, indicating that the loan amount could have been sent to the certain foreign accounts held by HDIL promoters,” he said.

Sources said the central probe agency would also look into the 21,049 dummy accounts to replace 44 borrowers, which the bank management had allegedly created to facilitate dubious transactions. The ED is soon expected to summon all the accused and also seek Wadhawans’ custody after EoW questioning.

Besides, ED suspects deep collusion and connivance between bank employees, auditors and some outside force in the matter. It also raises question why there were no red flags about PMC Bank’s huge exposure to HDIL constituted 73 per cent of the bank’s total loans.

HDIL is at centre of the PMC Bank scam as Thomas confessed that the bank’s exposure to HDIL is Rs 6,500 crore of the Rs 8,880 crore assets of the bank.

The police on Monday had also issued a lookout circular against Sarang and Rakesh Wadhawan. A special investigation team was formed to probe the case.

Thomas in a five-page letter to the Reserve Bank of India (RBI) dated September 21 confessed to the role of the top management in hiding the actual non-performing assets and the actual exposure to the bankrupt HDIL.

The HDIL fiasco came into the spotlight after an official tipped RBI about the irregularities in the bank’s books. The RBI had on September 23 placed PMC Bank under an administrator and suspended the management and also banned it from carrying out regular banking activities.

In a clarification letter written to the exchanges HDIL vice-chairman and managing director Sarang Wadhawan had said the loans taken from PMC Bank and other lenders were in the normal course of business after providing adequate security cover.

The debt-laden realty firm also said that its books of accounts are audited and reflect true and fair picture of the company's business.

Topics : PMC Bank Crisis HDIL PMC Bank