RBI eases norm for FPIs in corporate bonds by relaxing 20% exposure limit

FPIs had felt some restrictions were too onerous and difficult to monitor, and wanted these to be done away with

)

premium

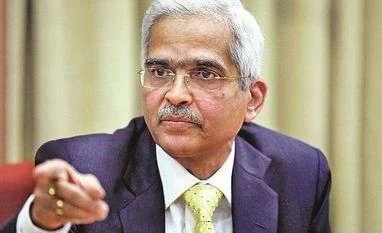

“After a prolonged period of stress, the banking sector appears to be on course to recovery as the load of impaired assets recedes” Shaktikanta Das, RBI Governor

The Reserve Bank of India (RBI) on Thursday relaxed the provision that Foreign Portfolio Investors (FPI) can't have an exposure of more than 20% of its corporate bond portfolio to a single corporate.