RBI monetary policy review: Bad loans limit banks from passing on rate cuts

Banks charge higher premiums on loans despite benefitting from a consistent regime of low-cost funding

)

premium

Compiled by BS Research Bureau; Source: RBI

Last Updated : Apr 06 2018 | 3:06 AM IST

With rising non-performing assets (NPAs), the country’s banking system finds itself unable to pass on the benefits of an easing monetary policy to its customers, states the Reserve Bank of India (RBI) in its first bi-monthly monetary policy report for financial year 2018-19.

The NPA problem has had an impact on monetary transmission, as banks charge higher premiums on loans despite benefitting from a consistent regime of low-cost funding.

Monetary policy transmission refers to the process by which asset prices and general economic conditions are affected by monetary policy decisions. For example, if the central bank cuts the repo rate by 50 basis points (bps), how long would it take for a retail borrower to receive the rate-cut benefit?

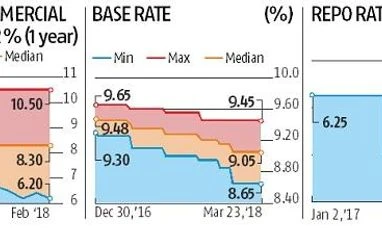

The pace of decline in the base rate has loosened since April 2016, the study notes, as the transmission of policy rate cuts to outstanding loans amounted to 55 bps during 2017-18 (up to February), as against 40 bps during 2016-17. This means monetary policy transmission has improved by 15 bps, despite the seething stressed asset problem.

Compiled by BS Research Bureau; Source: RBI

RBI researchers conducted a study on 72 banks — 26 public sector banks (PSBs), 19 private and 27 foreign banks — between Q1 of 2010-11 and Q1 of 2017-18. The study found that during periods (first period) of credit growth, the gross NPA ratio had a positive effect when it was at a low level, because banks were able to charge an additional “risk premia” that could compensate for the credit risk (gross NPA).

However, when the gross NPA ratio increased (second period), it had a significant and negative effect on monetary policy transmission, as banks could not shift the entire burden of rising NPAs onto new borrowers, in the form of higher credit risk premiums.

The researchers looked at the net interest margin (NIM), which is the difference between the interest income and interest expenditure, for the banks under analysis, and found that if monetary policy was eased (a rate cut), banks would not lower their lending rates in line with the reduction in their cost of funding.

Higher NPAs mean banks will charge a higher NIM to account for the increased credit risk, in order to maintain or sustain their targeted profitability, the study states. Essentially, when there is a deterioration in the asset quality, banks are inclined to charge higher spreads by charging a higher credit risk premia, which impedes the passing on of policy rate cuts to lending rates of commercial banks.

Since January 2015, the median base rate has declined by 80 bps, whereas there has been a cumulative decline of 200 bps in the policy repo rate.

Deposit and lending rates have been creeping upwards since December 2017, notes the report, in line with interest rates in other financial sectors.

Gross NPAs were found to have a negative impact on the NIMs of PSBs, but had a positive yet insignificant effect on the NIMs of private and foreign banks. PSBs have had substantially higher levels of NPAs, on aggregate across the sector, so at higher levels of NPAs they have not been able to compensate their risk and losses by charging a higher credit risk premium.

ALSO READ: Rupee surges 18 paise on bullish RBI growth call, low inflation forecast

ALSO READ: Rupee surges 18 paise on bullish RBI growth call, low inflation forecast