Reliance General got fresh approval from insurance regulator Insurance Regulatory and Development Authority of India (Irdai). It will also need approvals from Sebi and Registrar of Companies (RoC), before it can tap the public market.

Last year, Reliance General had all the approvals in place, but couldn't launch its IPO because of challenging market conditions and negative sentiments towards the group companies.

While not much has changed on that front, the company and bankers are hopeful that the IPO would sail through as the general insurer has shown an improvement in performance.

The IPO size would be in the range of Rs 1,500 crore to Rs 2,000 crore, said a banker.

Meanwhile, Reliance General has rejigged the list of investment bankers for the IPO.

It has roped in Citic CSLA and IndusInd Bank to replace UBS investment company and IDBI Capital. Motilal Oswal, Credit Suisse, Edelweiss and Haitong Securities will continue to be associated with the issue.

China-based Citic CLSA was also one of the lead banks for Reliance Nippon Life Asset Management Company (AMC) — the last Anil Ambani-group firm to come out with an IPO. The asset manager's Rs 1,540-crore offering in October 2017 had garnered more than 80 times subscription.

Just like Reliance Life AMC, Reliance General's IPO, too, will be a combination of fresh equity issuance and secondary share sale by Reliance Capital.

"No doubt the investor sentiment towards the group companies has taken a beating. But we are confident that Reliance General will be able to garner the desired amount. The company has posted impressive growth in the first half of the current financial year," said an investment banker handling the issue.

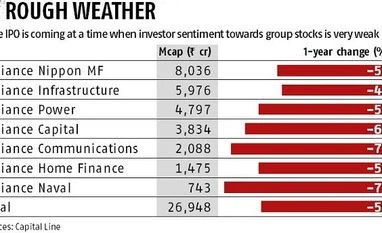

Shares of the seven listed Anil Ambani group companies fell between 3.3 per cent and 35 per cent on Monday after Reliance Communications moved bankruptcy court National Company Law Tribunal (NCLT) to resolve its debt issue. The combined market capitalisation erosion in the seven companies was Rs 6,310 crore.

In the past one year, the Anil Ambani group has seen its market value erode by 58 per cent, or Rs 37,417 crore, to Rs 26,948 crore, amid rising indebtedness.

The IPO plan signals that the group is confident that the debt trouble at group companies, including Reliance Communications, won't spill over to Reliance General. Through the IPO, general insurance arm could be valued anywhere between Rs 6,000 crore and Rs 8,000 crore, said a banker.

Sebi's approval for an IPO is valid for a period of one year. Reliance General's previous nod had expired in November. Typically, Sebi takes more than two months to vet and approve an IPO. However, in case of re-filing, the process gets completed early, said bankers.

)